Collections

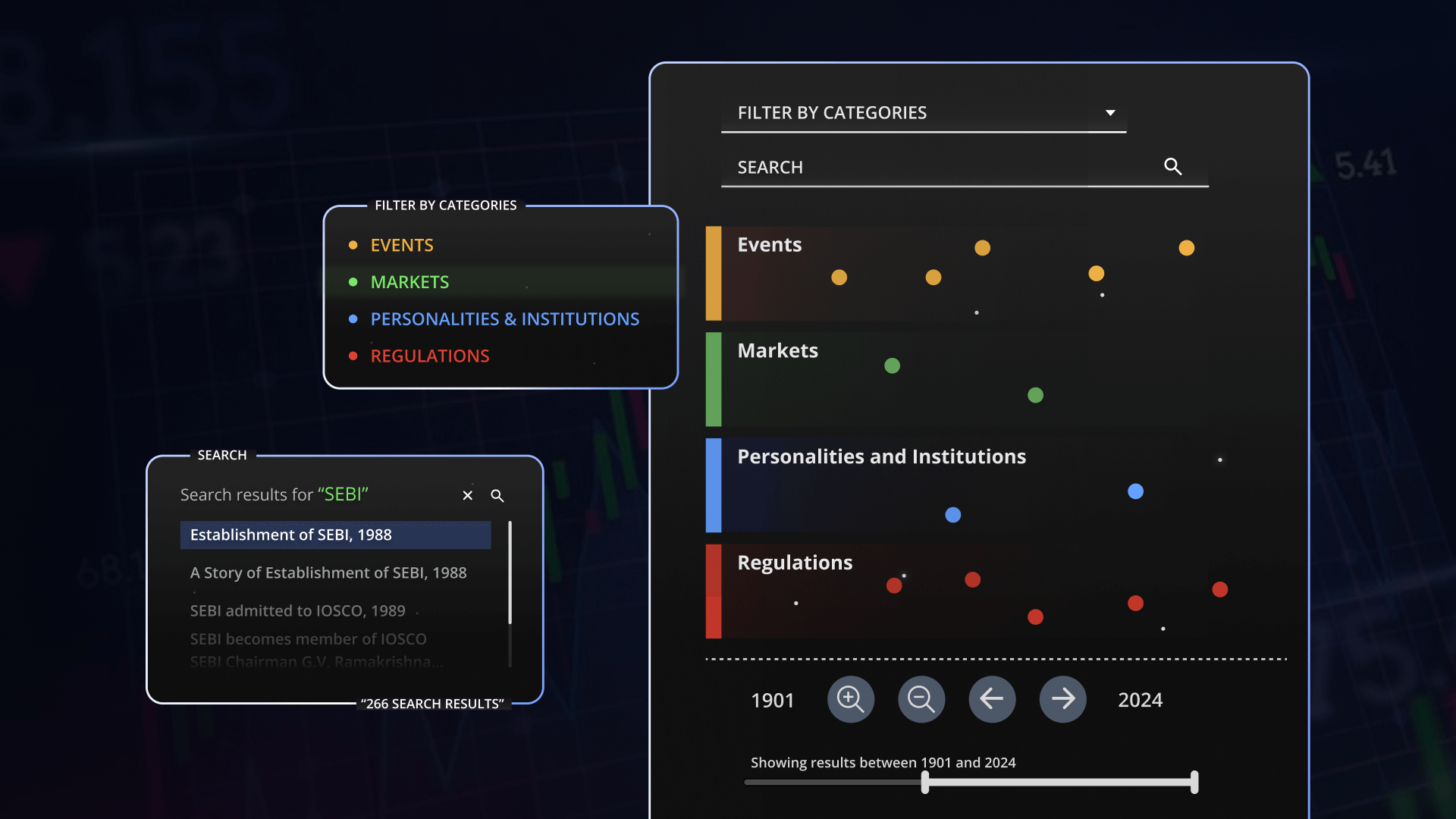

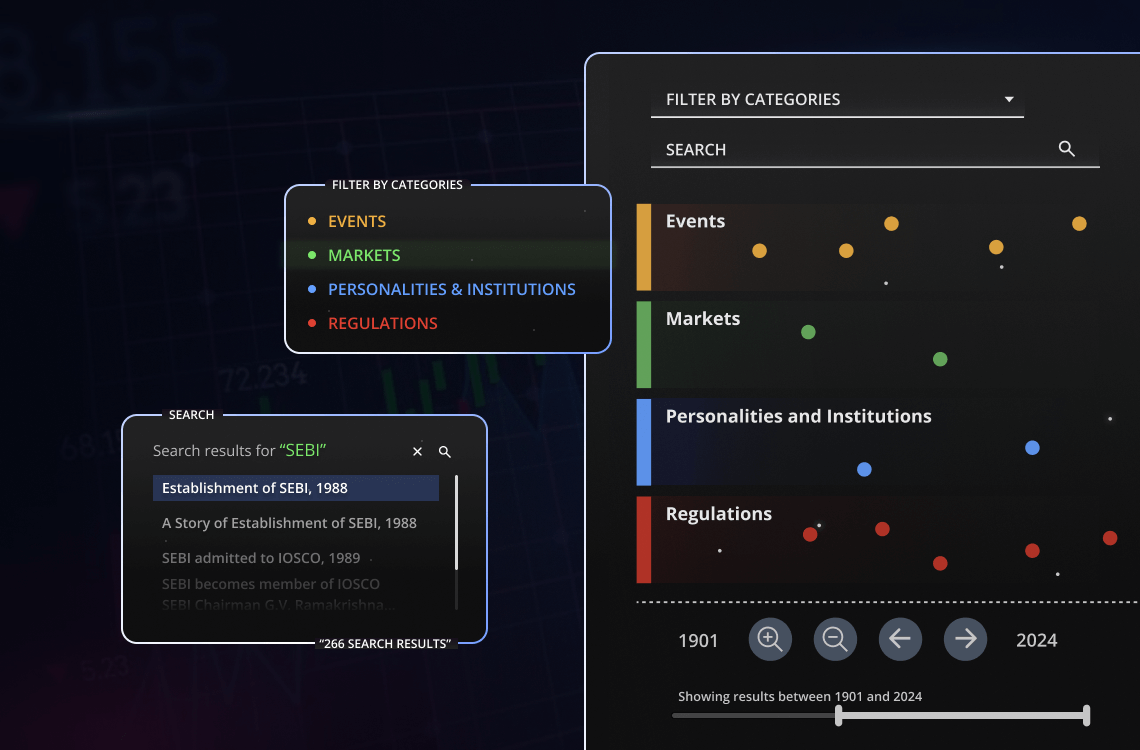

The Collections section of the Dharohar serves as a rich repository, containing hundreds of articles on key milestones, interviews with eminent personalities, historical share certificates (scripophily), educational resources, and newspaper clippings of significant events. This extensive archive offers valuable insights into the history of Indian securities market.

3D Galleries

The 3D Galleries offer an immersive virtual experience through eight exhibits. Four exhibits illustrate segment-wise evolution of the Indian securities market, while four exhibits are on Personalities, Scripophily, Spotlight and Games & Quizzes.

Logo Design

The design of the Logo for the Dharohar is inspired by the timeless simplicity of ancient visual scripts, such as Egyptian hieroglyphs, which showcase the power of geometric forms as fundamental building blocks. Presented in isometric view, the design reflects the milestones and growth.

Mission

The Dharohar intends to preserve, document and exhibit tangible and intangible heritage of Indian securities markets for the purposes of education, awareness, research and knowledge among general public, researchers, students etc.

About SEBI

The Securities and Exchange Board of India (SEBI) was constituted as a non-statutory body on April 12, 1988 through a resolution of the Government of India. Subsequently, SEBI was established as a statutory body in the year 1992 and the provisions of the Securities and Exchange Board of India Act, 1992 (15 of 1992) came into force on January 30, 1992.The Preamble of SEBI describes the basic functions of the Securities and Exchange Board of India as "...to protect the interests of investors in securities and to promote the development of, and to regulate the securities market and for matters connected therewith or incidental thereto"On April 12, 2024 SEBI turned 36. As we look back to the years gone by, we see 35 years of continuous, collaborative efforts at nurturing a securities market ecosystem which strives to facilitate cost effective, transparent and sustainable capital formation for the country.