Video Repository

Content Type

Category

Sort

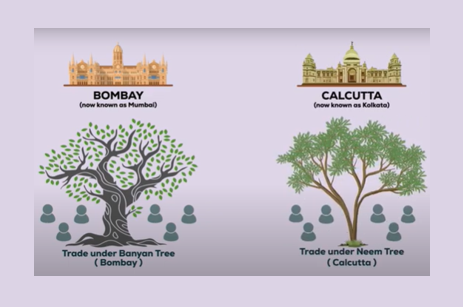

This video tries to trace the history of evolution of stock exchanges in India.

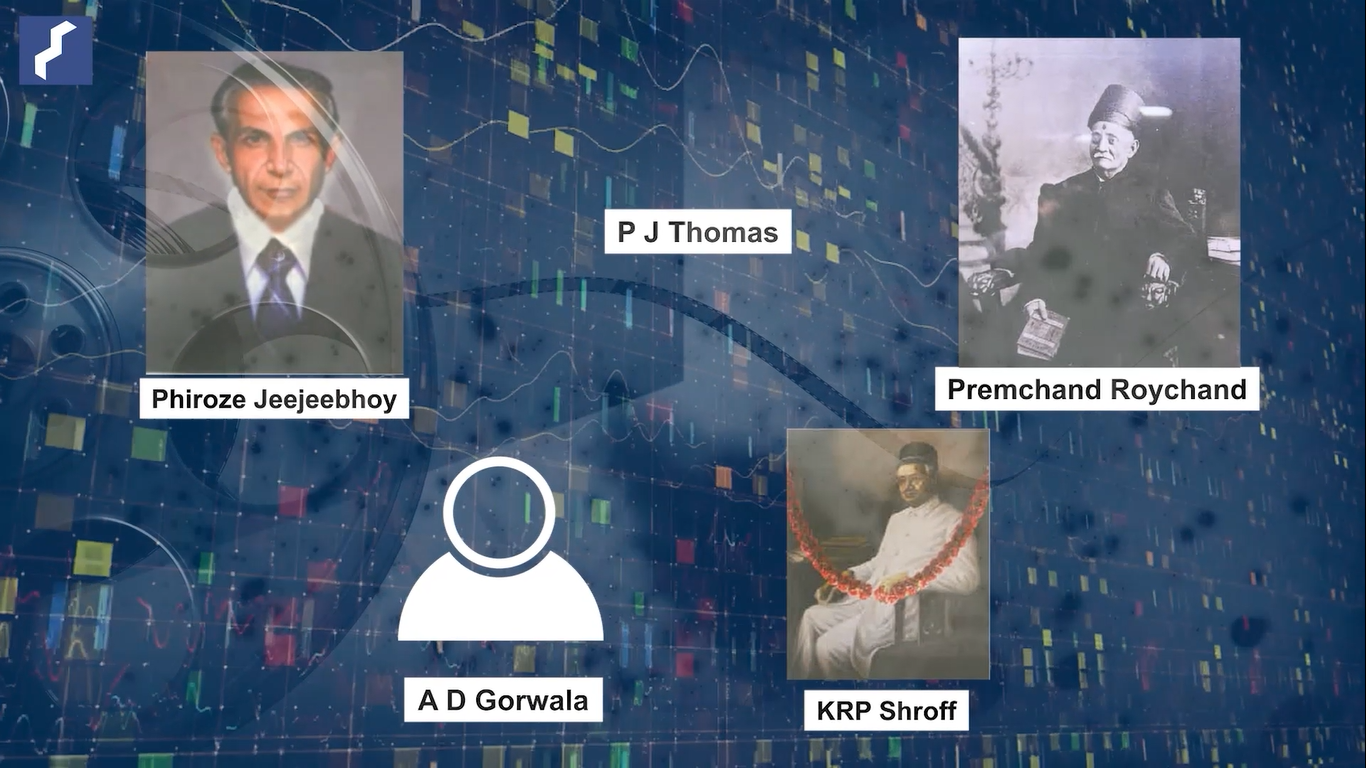

In continuation of earlier part, this video presents the personalities which shaped the Indian securities market.

This video gives a brief journey of clearing and settlement system

The video gives a brief account of SEBI (Substantial Acquisitions of Shares & Takeover Regulations), 2011 in India

The video gives a brief account of corporate governance in India.

Infographic Video - Evolution of Commodities Markets via Numbers

This video shows how SEBI utilized the technology for Convenience of Investors

Infographic Video - Overview of the Evolution of Commodity Derivatives Market in India

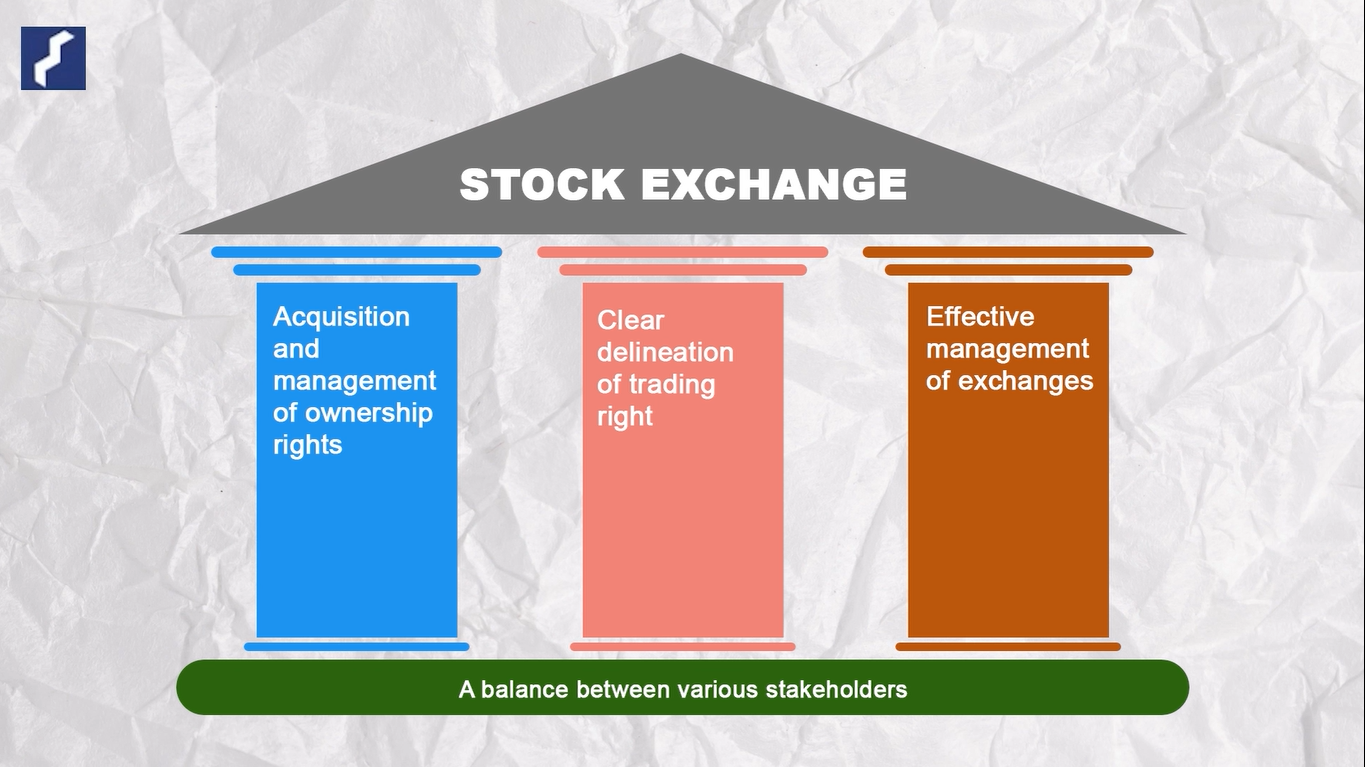

This video gives a brief on Corporatization and Demutualization of stock exchanges in India

This video is the first part of two video series showing the personalities which shaped the Indian securities market.

This video gives presents the evolution of markets in India with the help of Data.

The video gives a brief about the initiatives undertaken by SEBI for Investors protection

The video gives a brief about the emerging asset classes

This video gives a brief overview of the Corporate Disclosures regime in India.

This video is the part 2 of the series showing evolution of securities market regulations in India.

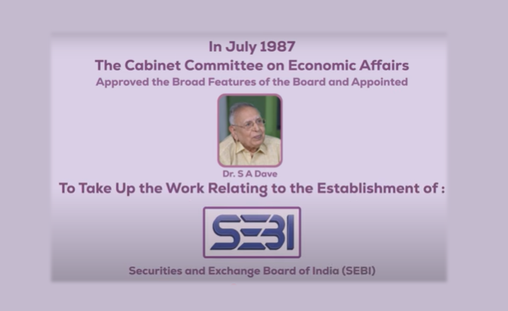

This video briefly tells the journey of SEBI

This video is the part 1 of the two-part series on regulations of securities market.

This video shows the performance of stock market during the wars.

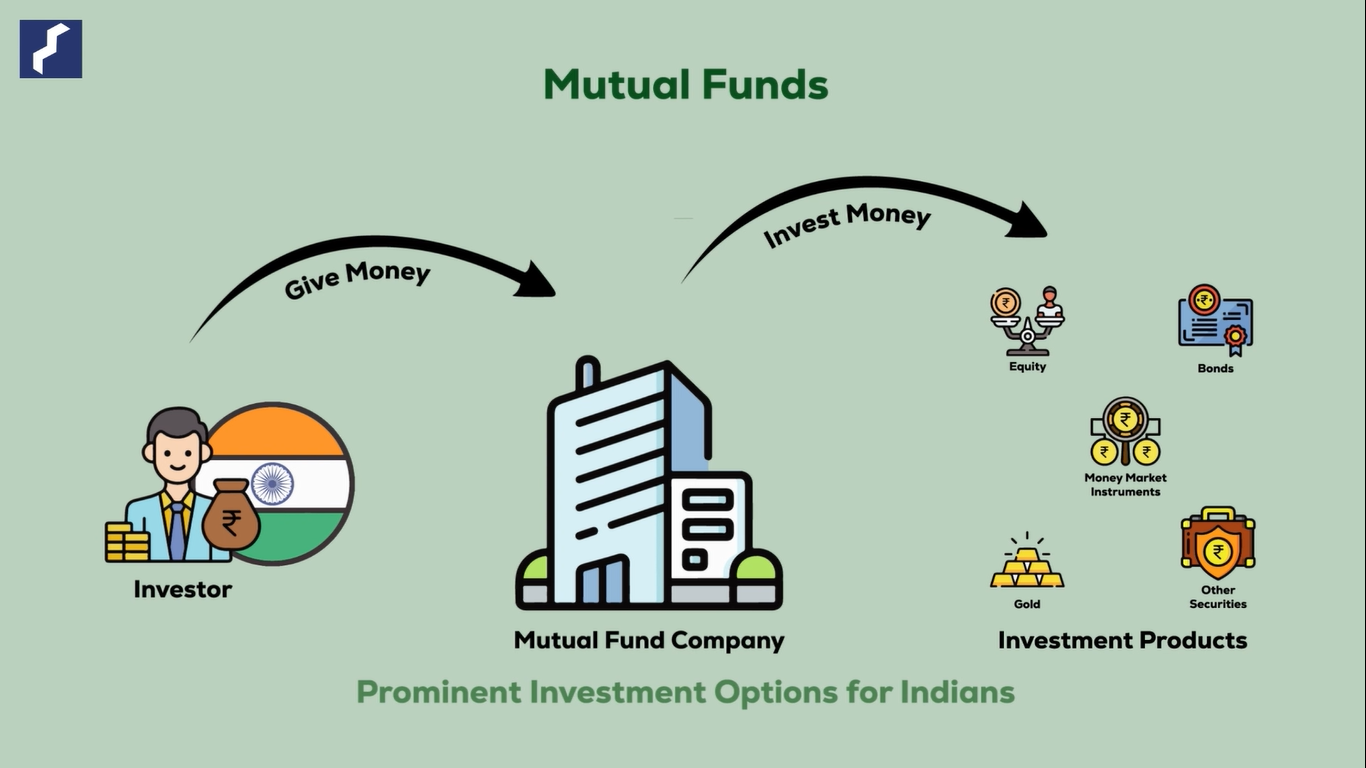

This video presents a brief on equity market investments in India

The dematerialization of Indian securities markets was a transformative shift in investment, addressing inefficiencies with physical share certificates. Initiated in 1996, a committee led by R Chandrashekharan recommended automation through Immobilization and Dematerialization. NSDL began operations in October 1996, marking the inception of demat accounts, followed by CDSL in 1999. SEBI progressively encouraged electronic share trading, first for institutional and then for retail investors. By March 2002, almost 100 percent of stock exchange trading occurred in demat form. The success is evident in the surge of demat accounts, surpassing 100 million by August 2022, with NSDL and CDSL having 3.41 crore and 10.09 crore demat accounts by November 2023. Policy interventions and digitization turned physical shares into digital assets, making dematerialization a significant success inspiring future generations.