Personalities and Institutions

Read Articles

View All

SEBI - An Evolution of Legislative Empowerment

The article traces the evolution of SEBI from its conceptualization in the G.S. Patel Committee Report, 1985 to its establishment in the year 1988, its empowerment through legislation as a statutory body in the year 1992 and beyond. Accordingly, this article highlights the salient features of Acts such as the SEBI Act, 1992, the Depositories Act, 1996, the Securities Contracts [Regulation] Act, 1956, and the Companies Act, 2013. The article also delves into the details of the important legislative empowerment of SEBI through legislative amendments in the years 1995, 1999, 2002, 2004, 2014, 2015 and 2019.

SEBI - An Evolution of Securities Market Reforms

The article explores SEBI's role in fostering the growth of the Indian securities market through transformative reforms, including derivatives trading, dematerialization, insider trading regulations, and the introduction of various investment products.

Collectibles of Handbook of Statistics

Following is the collection various Handbook of Statistics of Indian Securities Market. The Handbook of Statistics may be downloaded from the link provided.

Journey of the National Securities Depository Limited

The 1990s was a decade of significant change and transformation in India. This period witnessed economic liberalization, political developments, technological advancements, and cultural transitions.

A Story of Establishment of SEBI

The Securities and Exchange Board of India was established in 1988 following recommendations from various committees and the need for regulatory oversight in the Indian capital markets

Stock Market- A Historical Sketch.jpg)

Calcutta (Kolkata) Stock Market: A Historical Sketch

Calcutta (now known as Kolkata), the political and commercial capital of British India till 1911, boasted a thriving stock market activity that served as the nation's first financial hub. The establishment of the Calcutta Stock Exchange (CSE) was a response to the growing need for an official stock exchange. During its heyday, Calcutta provided a plethora of trading opportunities through three distinct stock exchanges, namely the Calcutta Stock Exchange, the Bengal Share and Stock Exchange, the Stock Exchange Association of Bengal and informal exchanges at Gudri and Katni. However, with the change in time, only CSE continued its operations, and the other exchanges vanished/discontinued their operations. The CSE enjoyed the status of one of the most prominent stock exchanges for a long time and also modernised its operations with the introduction of electronic trading system. However, the challenges emerged from the payment crises of 2001 and the emergence of national-level electronic trading platforms offered by BSE and NSE, as a result of which CSE struggled to keep afloat. This eventually culminated in its trading suspension in 2013.

-A Historical Journey.jpg)

Madras Stock Exchange (MSE): A Historical Journey

Madras Stock Exchange, established in 1920, was the first in the southern part of India. MSE played a notable role in the growth of industries in the southern region. By observing strict rules of conduct and ensuring high professional standards, MSE earned its esteem among the investing public as well as the entrepreneurs. In 1957, the Exchange registered itself under the Companies Act, 1955 and became a company limited by guarantee. The exchange was converted into a company limited by shares and obtained re-registration on November 18, 2005. MSE ensured to keep up with the technological advancements happening in the sphere of business. However, the expansion of national stock exchanges and the spread of their terminals all over India affected MSE, as did any other regional stock exchange. In 2001, MSE established its subsidiary company, MSE Financial Services Ltd. and acquired membership of NSE and BSE, through a provision provided by SEBI to the regional stock exchanges to revive their business. However, MSE decided to exit the stock exchange arena in 2014 and the same was stamped by the exit order passed by SEBI on May 14, 2015.

Journey of the BSE

The BSE is the oldest stock exchange in Asia and its origins can be traced back to the 1850s. The establishment of the BSE was influenced by various factors related to trade and business in Bombay (now Mumbai), which was a prominent commercial centre during British rule in India.

Permanent Registration for Market Intermediaries

SEBI previously followed a two-step process for registering market intermediaries, involving initial and permanent registration. However, to streamline the process and reduce compliance costs, SEBI decided to grant a one-step permanent registration to market intermediaries like merchant bankers, registrar to an issue and share transfer agent, bankers to an issue, underwriters, credit rating agencies, debenture trustees, depository participants, and KYC registration agencies.

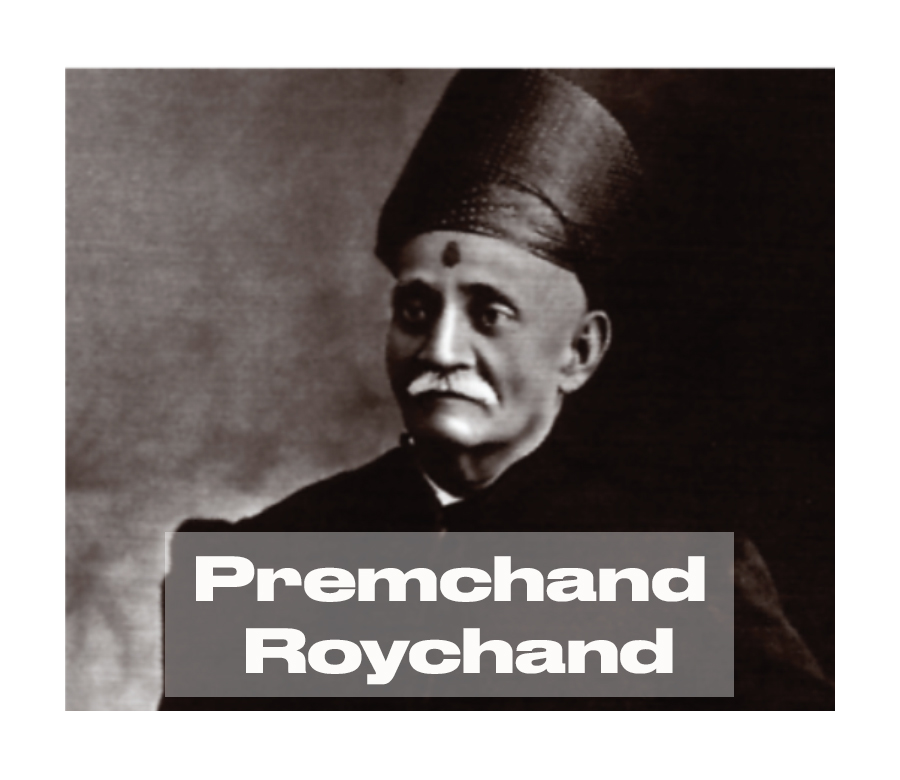

Premchand Roychand: The Rise, Fall, and Enduring Legacy of an Iconic Indian Stockbroker

During the 19th century, Shri Premchand Roychand was a prominent personality in financial market in Mumbai (earlier known as Bombay). Born in 1831, he rose from a modest background to become a key player in the stock market, ultimately founding the ‘The Native Share and Stock Brokers Association (later known as Bombay Stock Exchange and now BSE). His career coincided with a period of economic growth in Mumbai, driven by factors like the American Civil War's impact on the cotton trade. Premchand's influence extended to banking and land reclamation projects, marking stages of prosperity. However, the end of the Civil War led to a financial downturn, and he faced criticism and financial ruin. Despite this, Premchand Roychand's legacy endures through his philanthropic contributions and the recognition of his impact on Mumbai’s development. A dedicated gallery in Chhatrapati Shivaji Maharaj Vastu Sangrahalaya, Mumbai, has been established in his honor. The University of Calcutta gives out an award in his name i.e. Premchand Roychand Award to an outstanding student in Master of Arts every year. The Rajabai clock tower in Mumbai is named after his beloved mother, Rajabai Roychand.

Watch Videos

View All

Pratip Kar - Interview

History comes alive. Watch an interesting discussion of Mr. Pratip Kar, SEBI‘s longest serving Executive Director with Ms. Latha Venkatesh of CNBC. It is a rare insider‘s account of SEBI‘s origin, its initial struggles, its battles against major market scams, lots of untold stories and a candid take on its landmark successes you don‘t want to miss.

Sundararaman Ramamurthy - Interview

Listen to an in-depth conversation with Mr. Sundararaman Ramamurthy, MD and CEO of BSE, Asia’s first and fastest stock exchange. Established in 1875 as The Native Share and Stock Brokers’ Association, BSE has a rich legacy. This conversation covers a range of topics, from the evolution of stock exchanges to present-day market dynamics, including the role of technology, regulations, and more.

Nehal Vora - Interview

Interview with Shri Nehal Vora, MD and CEO of CDSL: Discover how decades of SEBI-led reforms turned a 19th-century, floor-traded market into a fully digital, AI-enabled ecosystem. Whether you’re an investor, policymaker or fintech enthusiast, this conversation with Shri Nehal Vora charts India’s unique journey from paper to pixels and previews what’s next for inclusive capital-market growth.

Journey of SEBI

This video briefly tells the journey of SEBI

D R Mehta - Interview

Interview with D R Mehta, Former Chairman of SEBI

Movers and Shakers of Indian Stock Market part 1

This video is the first part of two video series showing the personalities which shaped the Indian securities market.

Movers and Shakers of Indian Stock Market part-2

In continuation of earlier part, this video presents the personalities which shaped the Indian securities market.

Prashant Saran - Interview

Interview with Prashant Saran, Former WTM of SEBI

.png)

Mr. Sayeed Cassim - Interview

Interview with Mr. Sayeed Cassim, Scripophilist

.png)

Raman Uberoi - Interview

Interview with Raman Uberoi, Senior Advisor Government & Regulatory Relations, Crisil and Member of SEBI's Market Data Advisory Committee

View Images

View All

.png)

British East India Company, 1600-1874

"Founded on December 31, 1600, the British East India Company (EIC) held a pivotal role in the annals of global trade. Its joint stock shares were traded in London, consistently providing dividends until its dissolution in 1874. East India House, established in the 1720s, embodied the essence of EIC's operation. This unassuming yet bustling hub in London became the epicenter of early global commerce and finance for almost two centuries. Within its walls, momentous decisions were made. EIC, dealing in goods such as tea, spices, and textiles, charted treacherous seas and intricate trade networks, reaping profits and inviting controversy. The company's ships sailed to distant shores, impacting the course of history by shaping trade routes and influencing world events. East India House isn't adorned with the grandeur of palaces; instead, its halls resonate with tales of ambition, rivalry, and, occasionally, exploitation. This historic site embodies how business interests could profoundly shape the world. The museum plaque here commemorates a chapter where trade and finance converged, sometimes for the better, and at times, for the worse."

Central Depository be a reality soon

Last minute touches were given to the custodial and depository services bill, which is certain to be introduced during the monsoon session of Parliament, an official source said.

Establishment of OTCEI

Leading financial institutions are promoting a new company called Over Counter Exchange of India (OTCEI). The promoters, Industrial Credit and Investment Corporation of India Ltd., Industrial Bank of India, Industrial Finance Corporation of India, Life Insurance of India, General Insurance of India, SBI Capital Markets and Canbank Financial Service Ltd., contributed Rs. five crore as aid-up capital.

NSE to set up securities clearing corporation

The National Stock Exchange (NSE) has decided to establish a National Securities Clearing Corporation (NSCC). The announcement was made at the NSE annual general meeting. This will be the first clearing agency of its kind in India, with the exchange guaranteeing all the transactions carried out through the market.

AMBI registered

The Association of Merchant Bankers of India (AMBI) which has been in the making for over five years now has finally been registered as a official body.

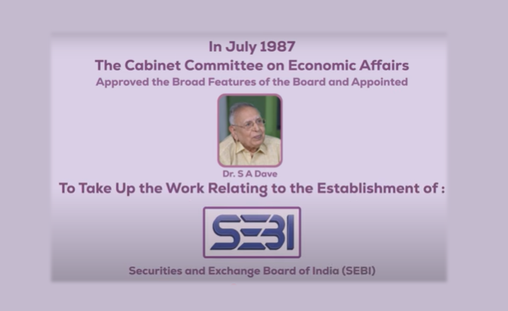

Dr. S A Dave appointed as First Chairman of SEBI

Government of India have set up Securities and Exchange Board of India that is SEBI The aim of SEBI was to deal with all the matters relating to development and regulation of securities market and investors protection and advised government on these matters Dr. S A Dave was then the Executive Director of IDBI He had been appointed as the first Chairman of SEBI

Appoitment of Mr. G V Ramakrishna as SEBI Chaiman

Mr G.V Ramakrishnana has been appointed the new chairman of the Securities and Exchange Board of India (SEBI). A new Chairman for SEBI became necessary when Mr. S A Dave, the first SEBI Chairman also took up the stewardship of Unit Trust of India with the exit of Mr. M J Pherwani.

Stock exchanges, brokers may fund SEBI

Strongly opposing the turnover tax proposal, the presidents of the major stock exchange in the country, who conducted their two-day meeting, proposed the payment of a lump sum amount by stock exchange and its members as well as contribution by companies as a percentage of listing fees on the security and exchange board of India (SEBI)