Regulations

SEBI exercises regulatory and supervisory control over the securities market by issuing the regulations, guidelines, and circulars to various market intermediaries and participants. This includes entities such as mutual funds, stock brokers, merchant bankers, depositories, depository participants, custodians, credit rating agencies, among others.

Read Articles

View AllD C Anjaria Committee on Review of SEBI Fee Structure for Stock Brokers

The fee structure for the brokers prescribed in the regulations was based on the recommendations made way back in 1992 by the R S Bhatt Committee. The recommendations of the Committee were based on the then level of brokerage earned by the brokers. Over the next decade, the market structure witnessed sea change, which coupled with fierce competition among brokers, has brought down the level of brokerage drastically. This necessitated a review of the fee structure for the stock brokers. Accordingly, on January 21, 2002, SEBI constituted a Committee under the Chairmanship of Mr. D. C. Anjaria to review the fee structure for the stock brokers. The Committee submitted its report during November 2003.

Watch Videos

View All

Evolution of Securities Market Regulations part 1

This video is the part 1 of the two-part series on regulations of securities market.

Evolution of Securities Market Regulations part 2

This video is the part 2 of the series showing evolution of securities market regulations in India.

Initiatives for Protection of Investors

The video gives a brief about the initiatives undertaken by SEBI for Investors protection

View Images

View All

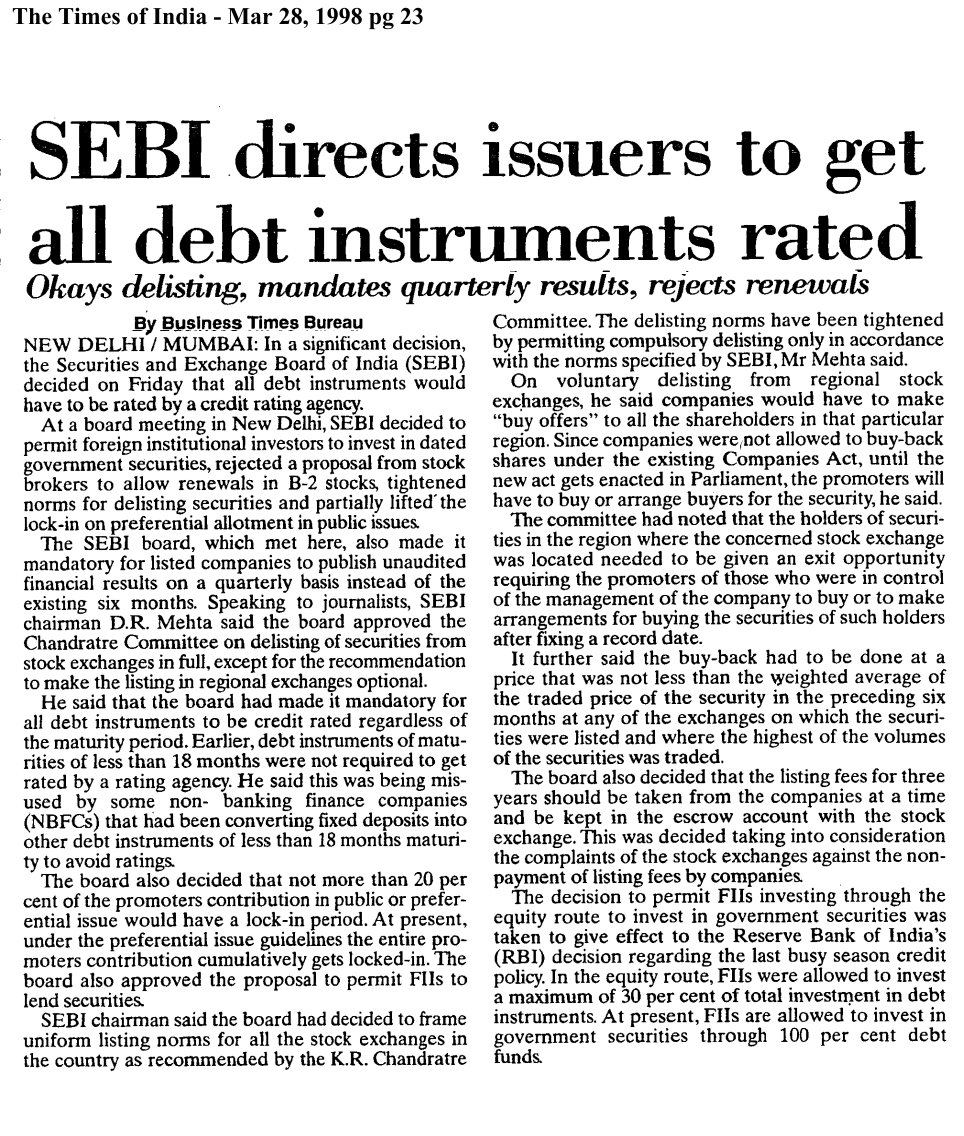

SEBI directs issuers to get all debt instruments rated

In a significant decision, the Securities and Exchange Board of India (SEBI) decided that all debt instruments would have to be rated by a cred rating agency.

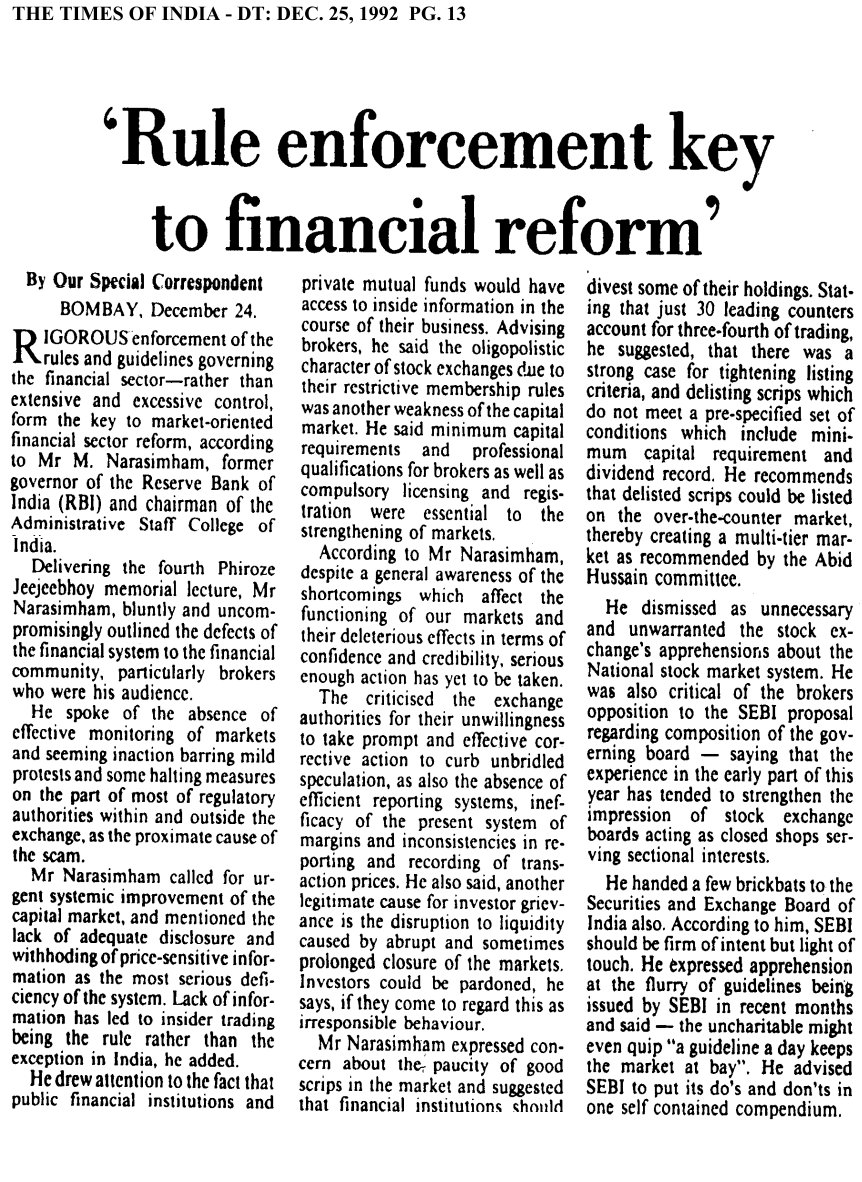

Rule enforcement key to financial reform

Rigorous enforcement of the rules and guidelines governing the financial sector - rather than extensive and excessive control, form the key to market -oriented financial sector reform, according to Mr. M Narasimham, former governor of the Reserve Bank of India (RBI) and chairman of the Administrative Staff College of India.

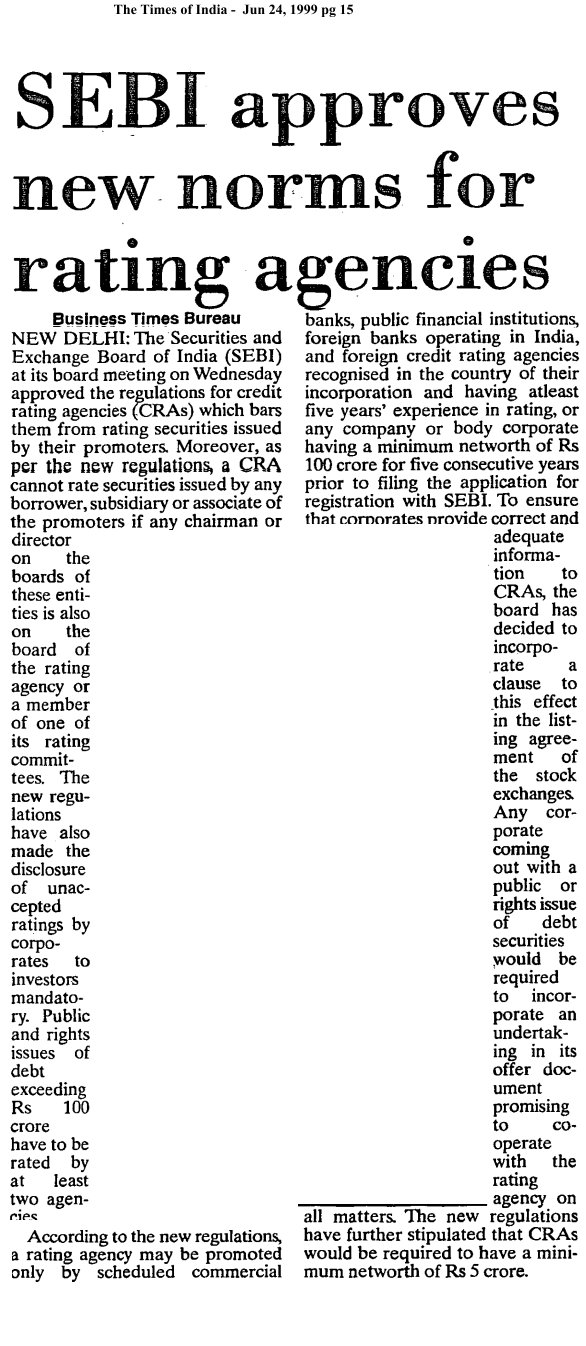

SEBI approves new norms for rating agencies

The Securities and Exchange Board of India approved the regulations for credit rating agencies (CRAs) which bars them from rating securities issued by their promoters, moreover as per the new regulations, a CRA cannot rate securities issued by any borrower, subsidiary or associate of the promoters if any chairman or director.

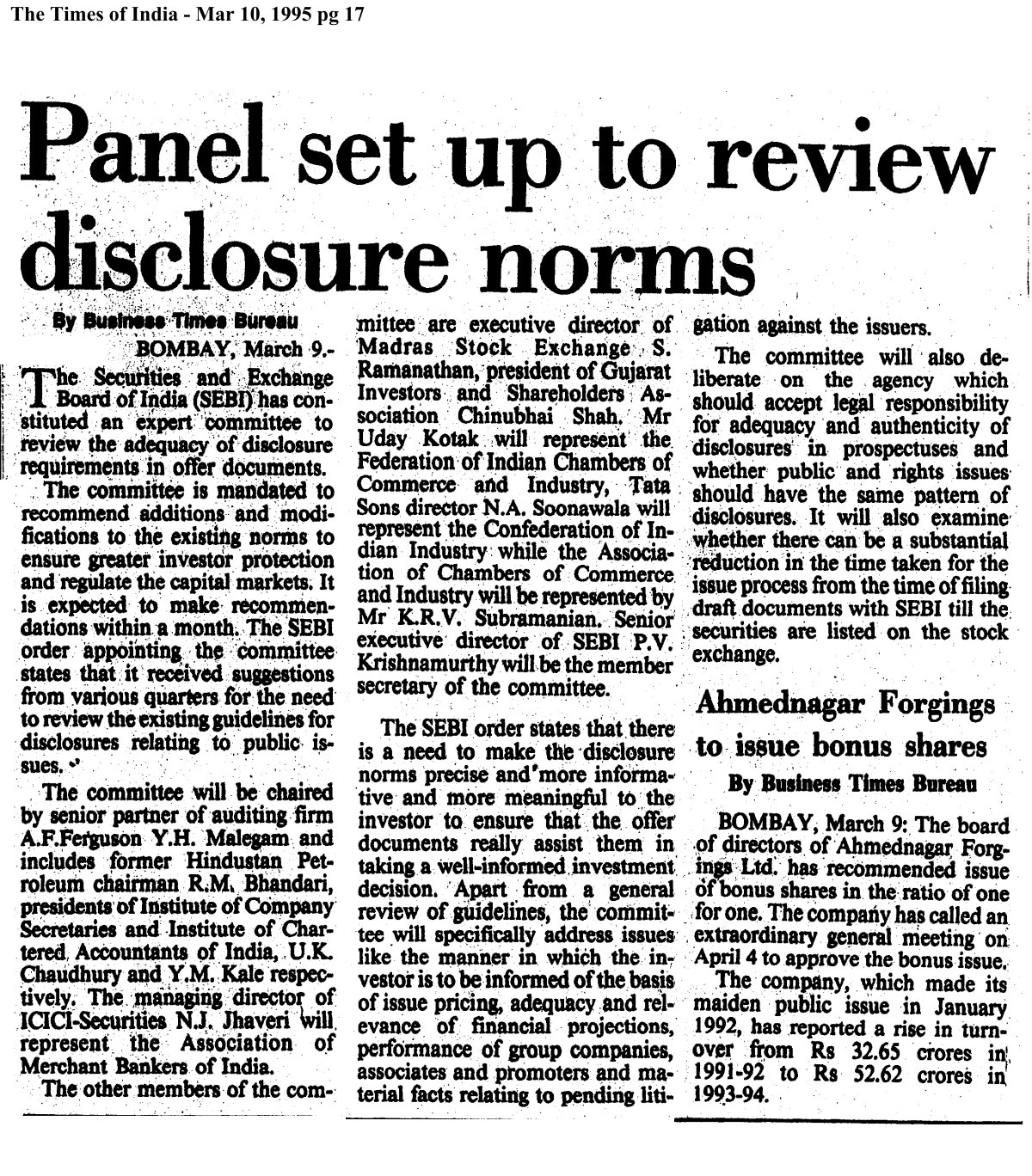

Panel set up to review disclosure norms

The Securities and Exchange Board of India has constituted an expert committee to review the adequacy of disclosure requirements in offer documents.

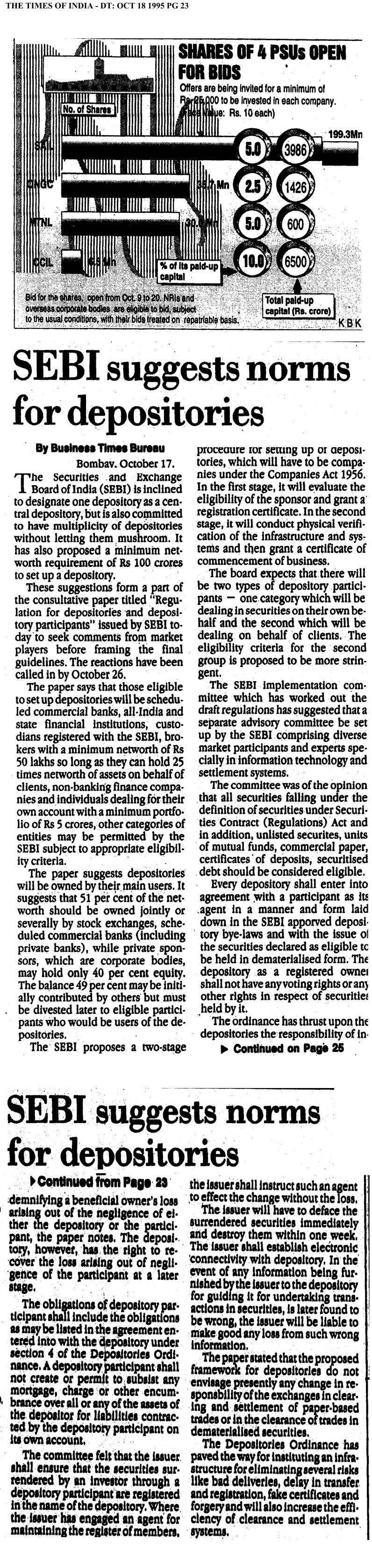

SEBI suggests norms for depositories

The Securities and Exchange Board of India is inclined to designate on depository as a central depository, but also committed to have multiplicity of depositories without letting them mushroom. It has also proposed a minimum net worth requirement of 100 crores to set up a depository.

When freedom means regulation

We must prepared for harsh discipline' said Mr. Ramakrishna at a seminar. But a free market will automatically create a need for regulation. He also said, no Indian businessman who groans under the controls, has yet been penalised to the point where it sets an example for the community....

SEBI gets more regulatory powers

Stock prices have flared up in kerb deal on the announcement that the Securities Contracts Regulations Act has been amended through an ordinance promulgated by the President of India deleting the prohibition on "options".

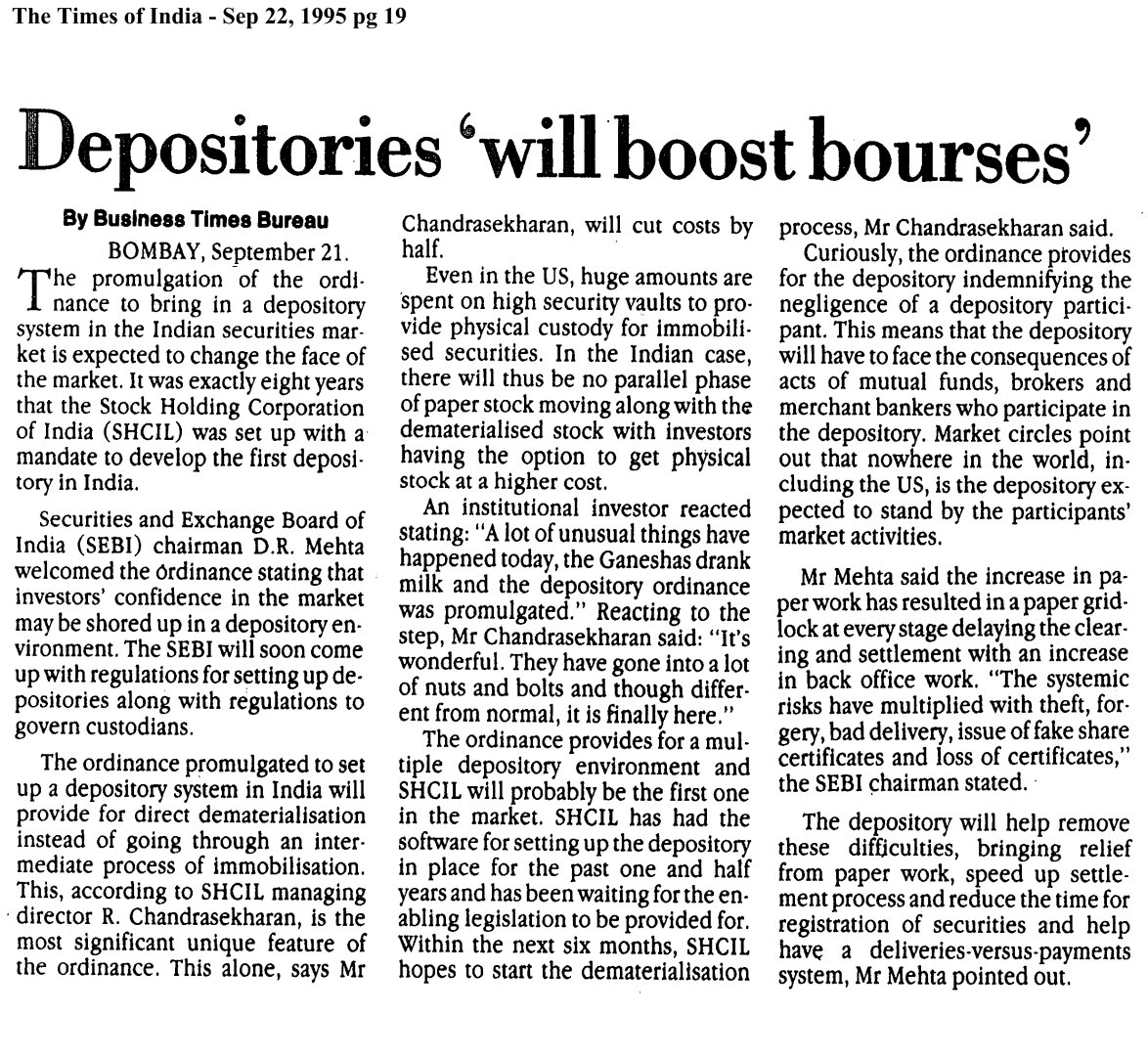

The Promulgation of the Ordinance to bring in a depository system

The promulgation of the ordinance to bring in a depository system in the Indian Securities market is expected to change the face of the market. It was year 1986 when the Stock Holding Corporation of India was set up with a mandate to develop the first depository India.

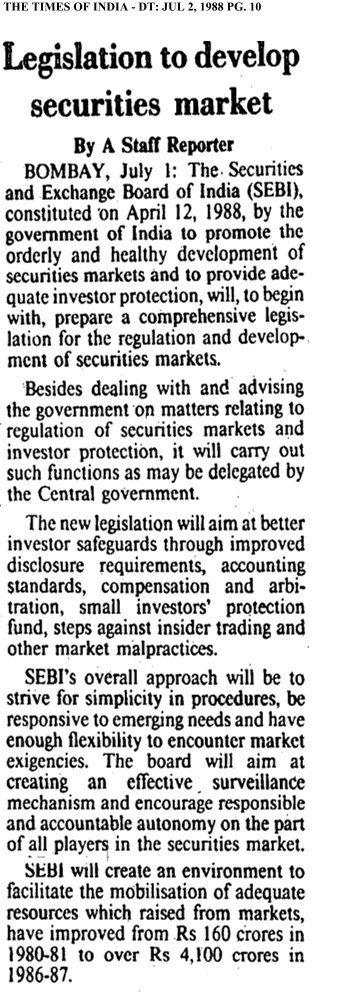

Legislation to develop securities market

The Securities and Exchange Board of India (SEBI), constituted on April 12, 1988, by the government of India to promote the orderly and healthy development of securities markets and to provide adequate investor protection, will to begin with, prepare a comprehensive legislation for the regulation and development of securities markets.

Strengthening control over joint stock firms

The 12 man committee, which began its work under the Chairmanship of Mr. C H Bhabha in January 1951, suggested the constitution of an autonomous, four man corporate investment and administration commission with the statutory status and wide powers to regulate, control, inspect and guide the administration of the joint stock companies under the reformed laws.

.png)