Brief Introduction of Equity Markets

Equity markets comprise of the electronic ecosystem and processes through which, investors buy and sell shares of publicly traded companies and also through which companies (listed and unlisted) raise capital from public/selected shareholders. Equity Shares, or commonly called as shares, represent a share of ownership in a company. An investor who invests in shares of a company is called a shareholder, and is entitled to receive all corporate benefits, like dividends, capital appreciation, bonus shares, etc of that company.

The primary function of equity market is to enable channelization of savings from investors who have money to those who need it. Equity markets also enable companies to be traded publicly and raise capital to grow their businesses, expand operations and create capital formation and jobs in the economy. The equity market constitutes two main segments:

Primary market - Unlisted /listed companies can access primary markets for raising capital through initial public offering, further public offering , rights issues, preferential allotments and qualified institutional placements. Pursuant to an IPO, company is listed at the stock exchange.

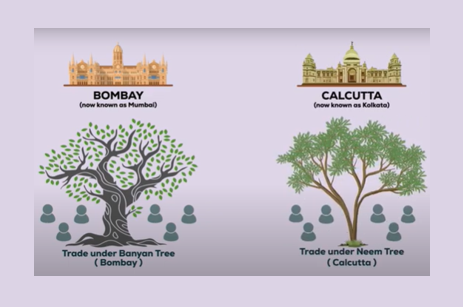

Secondary market - Buying or selling of shares of companies listed at stock exchanges happens under the domain of secondary markets. The process of buying or selling shares online in India has been made smooth and seamless, due to systematic functioning stock exchanges, clearing corporations and depositories , (collectively called Market Infrastructure Institutions-MIIs) and a host of intermediaries. In India, there are two main stock exchanges for equity (share) trading viz Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). Presently (at the end of November 2023), there are about 5300 companies listed on BSE and about 2300 companies listed on NSE. At the end of November 2023, value of the outstanding shares listed (market cap), on an all-India basis, stood at Rs.341 lakh crore.

Over the years, equity markets have facilitated corporates, large and small, in raising resources and is an important avenue for long-term wealth creation for investors.

Read Articles

View All

The Journey from “Badla” to Derivatives

Badla, once a symbol of speculative fervour, faced numerous challenges and regulatory scrutiny throughout its journey in India's stock markets. While it provided flexibility, it was also marred by manipulation and risks. Its eventual decline marked a shift toward more stringent regulations and a focus on investor protection, shaping the evolution of India's financial landscape. The rise and fall of Badla in India's stock markets reflect the complex interplay between market innovation, regulatory oversight, and investor behaviour. From its origins as a solution to liquidity challenges, Badla transformed into a tool for speculation, driving both market growth and instability. The Atlay and Morison Committees, along with SEBI's interventions, highlighted the need for balance in market dynamics. The regulatory journey, marked by periodic bans and reinstatements, underscores the challenges of managing a dynamic financial ecosystem. As India's financial landscape continues to evolve, the legacy of Badla serves as a reminder of the importance of adaptive regulation and proactive oversight. While Badla may have faded into history, its impact on India's stock market development remains a crucial chapter in the nation's financial narrative. Investors, regulators, and market participants can draw valuable lessons from this historical journey, shaping a more resilient and transparent financial future for India.

Introduction of T+1 Rolling Settlement Cycle by Stock Exchanges

In April 2002, the Indian capital markets introduced the T+3 rolling settlement cycle. The settlement cycle of T+3 under the Rolling Settlement System was shortened further to T+2 rolling settlement, w.e.f. April 01, 2003. With the objectives of mitigating risk, enhancing liquidity and increasing the efficiency of the settlement process, flexibility has been provided to recognized stock exchanges (“SEs”) to offer either T+1 or T+2 settlement cycle, w.e.f. January 01, 2022. This move positioned India as one of the earliest adopters of the T+1 settlement cycle. Accordingly, the T+1 was introduced by the stock exchanges on February 25, 2022 for limited set of stocks, while complete transition took place on January 27, 2023.

Segregation and Monitoring of Collateral at Client Level

In order to further strengthen the mechanism of protection of client collateral from (i) misappropriation/ misuse by TM/ CM and (ii) default by TM/CM and/or other clients, SEBI introduced the framework for segregation and monitoring of client collateral to enable identification of collateral at the client level.

Framework for issuance of Differential Voting Rights (DVR) shares

New technology firms that have asset-light models (relatively fewer capital assets compared to the value of their operations) generally prefer equity over debt capital, as raising equity on a periodic basis leads to the dilution of founder/promoter stakes. For these promoter-led firms, retaining the founder’s interest & control in the business is of great value and Differential Voting Rights (DVR) shares as a mode of capital raising can effectively address the concerns. Based on the report of the DVR Group and the feedback received on the consultation paper floated by SEBI in March 2019, the issuance of shares with superior voting rights (SR shares) has been introduced under SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018

Evolution of Company Laws in India

This article explores the historical evolution and significance of Indian Companies Acts from 1850 to 2013 in shaping corporate governance and the securities market in India. It highlights key milestones in the development of company laws, such as limited liability, mandatory audits, financial disclosures and the establishment of regulatory bodies like SEBI. The article also discusses the impact of these acts on corporate governance practices, transparency, accountability, and investor protection. It emphasizes how these legal frameworks have facilitated economic growth and attracted investment, with iconic companies benefiting from the evolving regulatory environment. The Companies Act of 2013, with its modernization efforts, is seen as a turning point in promoting a transparent and investor-friendly corporate environment.

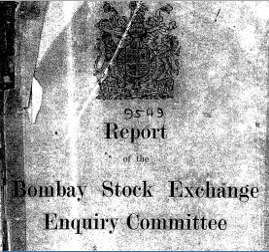

Bombay Stock Exchange Enquiry Committee (Atlay Committee)

The Committee was constituted by Government of Bombay in 1923 under the chairmanship Sir Wilfrid Atlay to enquire into the constitution, customs, rules, regulations and methods of business of the Native Share and Stock Brokers’ Association of Bombay with a view to protecting the investors and formulating future proposals. The Committee found that the Native Share and Stock Brokers’ Association of Bombay was a voluntary association with over 400 members, primarily focused on protecting member interests and providing a market for buying and selling stocks and securities, with rules and regulations regularly updated.

Introduction of Graded Surveillance Measures (GSM)

SEBI GSMs work as pre-emptive steps to reduce/check instances of market manipulation in identified scrips. GSMs are intended to deal with the abnormal increases in share prices of companies that are apparently not in line with their disclosed fundamentals or business models, particularly those with poor fundamentals.

Streamlining the Process of Rights Issue process and the dematerialized REs framework

SEBI laid down the detailed procedure of the improved Rights Issue process and the dematerialized REs framework.

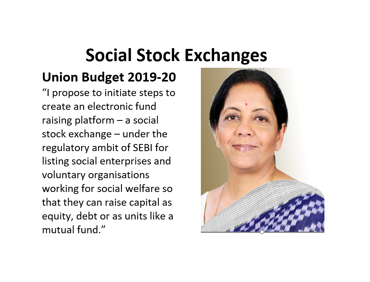

Operationalisation of Social Stock Exchange

In the Union Budget 2019-20, the creation of Social Stock Exchange (SSE) was proposed by the government, under the regulatory ambit of SEBI, for facilitating fund raising by social enterprises (SEs). The SEBI Board approved the creation of SSE on September 28, 2021, pursuant to public consultations and deliberations, and the recommendations of Working Group and Technical Group on SSE.

UPI based fund blocking mechanism for trading in secondary market

In its continuing endeavour to safeguard investors’ assets from misuse/ default by brokers, SEBI introduced a process for trading in secondary markets based on “blocked funds in investors’ bank account” instead of transferring the funds upfront to the broker. The mechanism harnesses public digitalisation infrastructure by integrating RBI approved Unified Payment Interface (UPI) mandate service (single block and multiple debits) with the secondary market trading and settlement process.

Watch Videos

View All

Evolution of equity investment cult in India

This video presents a brief on equity market investments in India

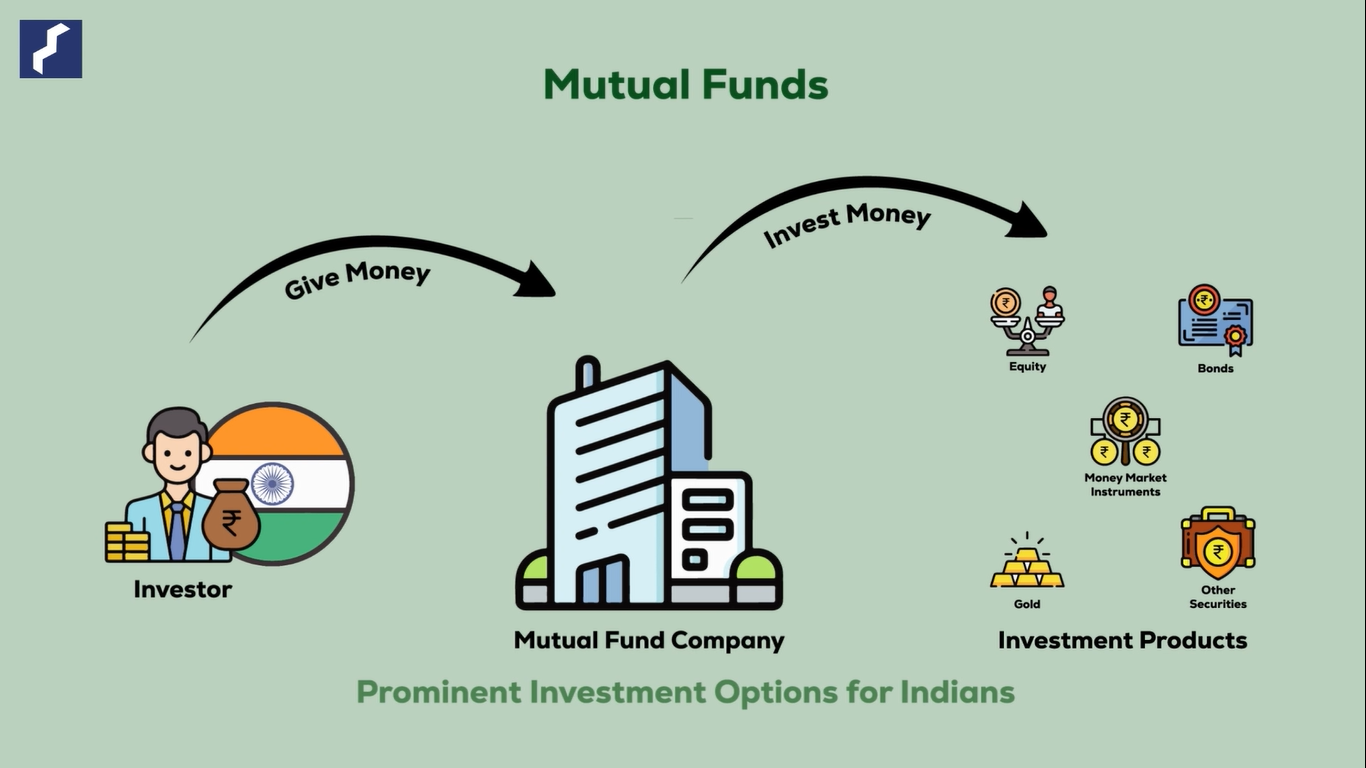

Evolution of Mutual Funds through numbers

This video gives presents the evolution of markets in India with the help of Data.

AIFs, REITs and INvITs

The video gives a brief about the emerging asset classes

Evolution of SAST Regulations, 2011

The video gives a brief account of SEBI (Substantial Acquisitions of Shares & Takeover Regulations), 2011 in India

View Images

View All

Flag off derivatives with index futures: SEBI panel

The secondary market advisory committee of the Securities and Exchange Board of India, in its meeting here on Monday, April 20, 1998 discussed the Dr. L. C. Gupta committee recommendations on derivatives trading and agreed that derivatives should be introduced in a phase manner, beginning with index future.

Rolling settlement set to commence from January 10, 2000

The securities and Exchange Board of India (SEBI) sets January 10, 2000 for commencement of rolling settlement in a phase manner. Initially, rolling settlement will be kicked off with 10 scrips.

NSE launches new mid-cap index

The National Stock Exchange to launch the "Junior Nifty" mid-cap index, comprising 50 stocks with a base period of November 4, 1996. The Index having representation of companies with medium-sized capital in the Indian capital market, is expected to have high hedging effectiveness for portfolios with midcap companies and appropriate for index based derivatives.

Cabinet decision on derivatives trading cheers market

The mild tension in the minds of key market participants, especially senior exchange official, disappeared as soon as news of the Union cabinet clearing derivatives trading reached the city.

Entering the world of options and futures

Newspaper article on the occasion of introduction of Options and Futures in Indian Securities Market.

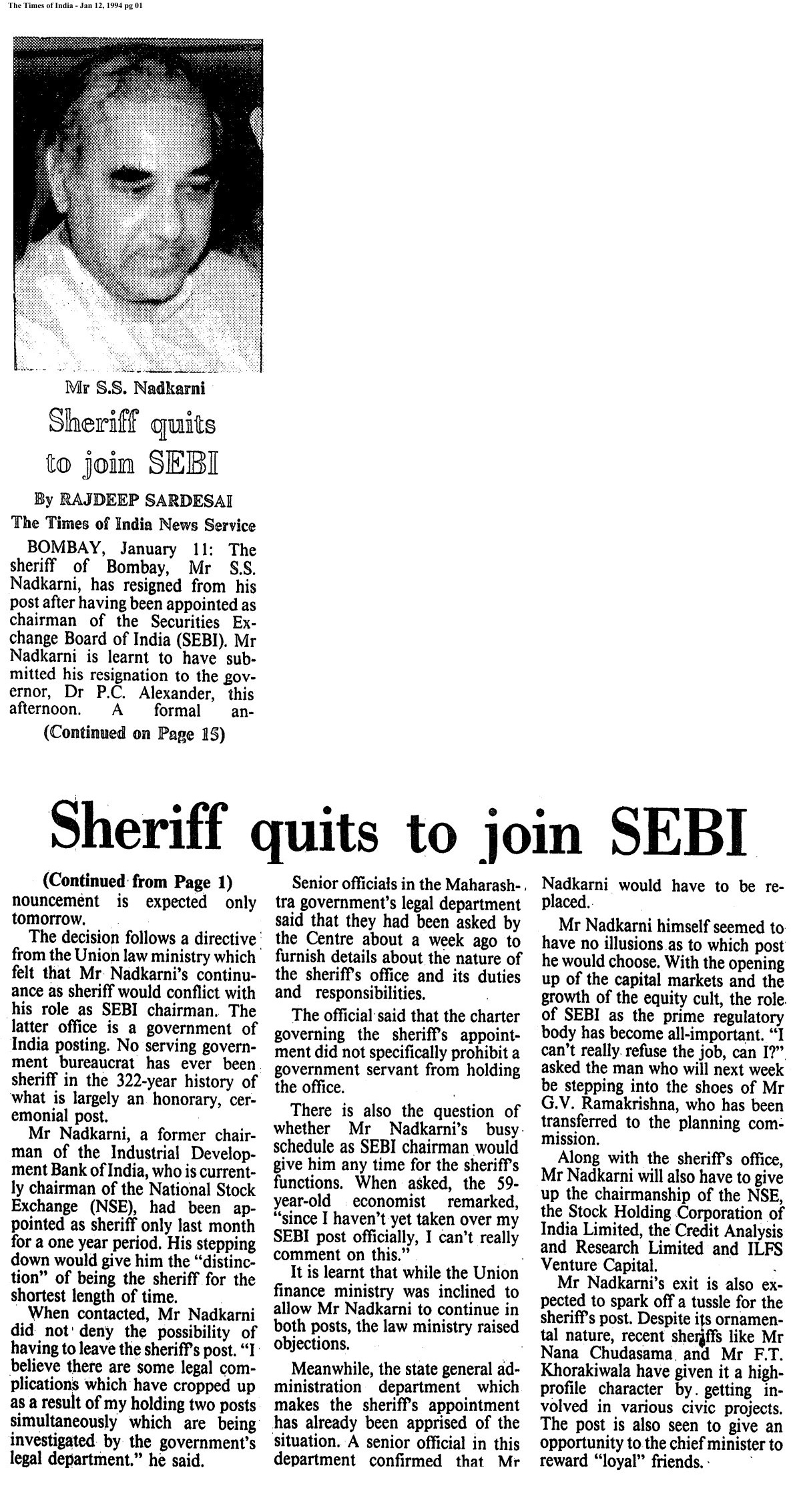

Sheriff quits to join SEBI

The sheriff of Bombay, Mr. S S Nadkarni resigned from his post after having been appointed as Chairman of SEBI. The Decision follow a directive from the Union law ministry which felt that Mr Nadkarni's continuance as sheriff would conflict with his role as SEBI chairman. The latter office is a government of Indian posting. No serving government bureaucrat has ever been sheriff in the 322-year history of what is largely an honorary, ceremonial post.

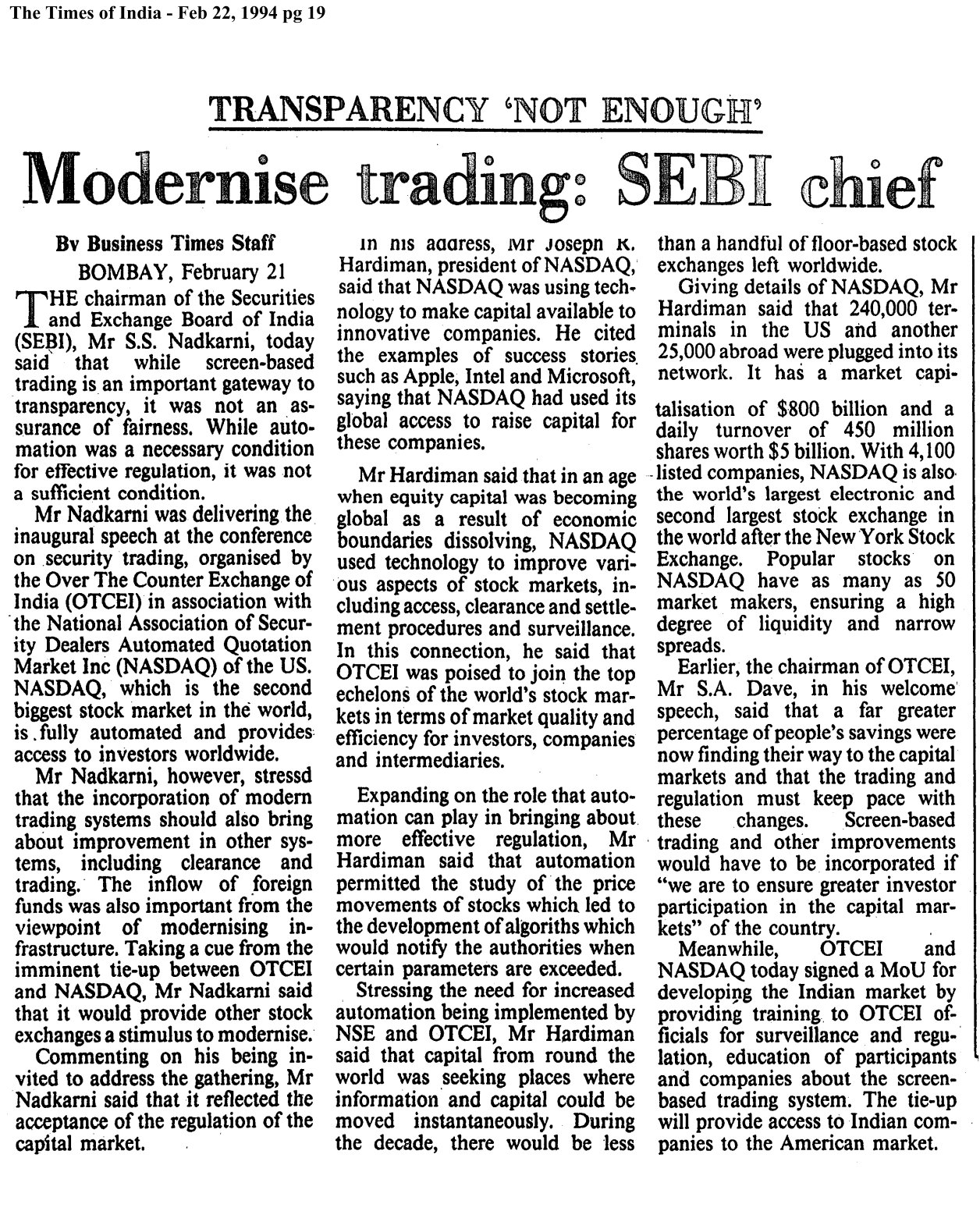

Transparency not enough- Modernise trading SEBI chief

The Chairman of Securities and Exchange Board of India (SEBI), Mr S.S Nadkarni, said that while scree-based trading is an important gateway to transparency, it was not an assurance of fairness. While automation was a necessary condition for effective regulation, it was not sufficient condition.

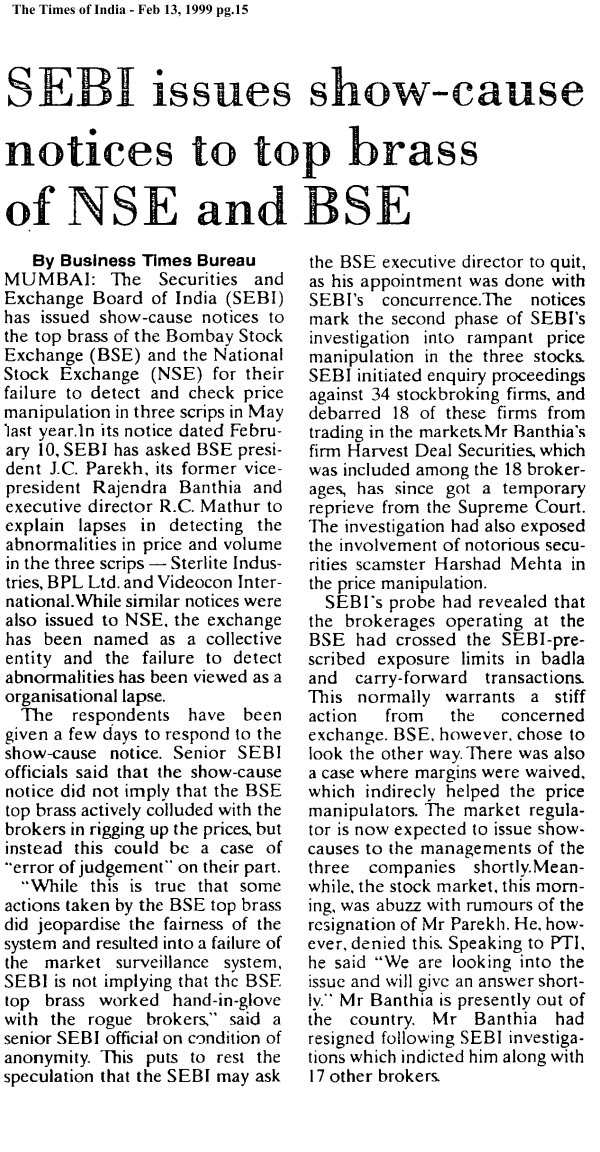

SEBI issues show-cause notices to top brass of NSE & BSE

The Securities and Exchange Board of India (SEBI) has issued show-case notices to the top brass of the Bombay Stock Exchange (BSE) and the National Stock Exchange(NSE) for their failure to detect and check price manipulation in three scripts ,in its notice dated February 10, SEBI asked to explain lapses in detecting the abnormalities in price and volume in the scrips -Sterile Industries, BPL Ltd and Videocon Industries.

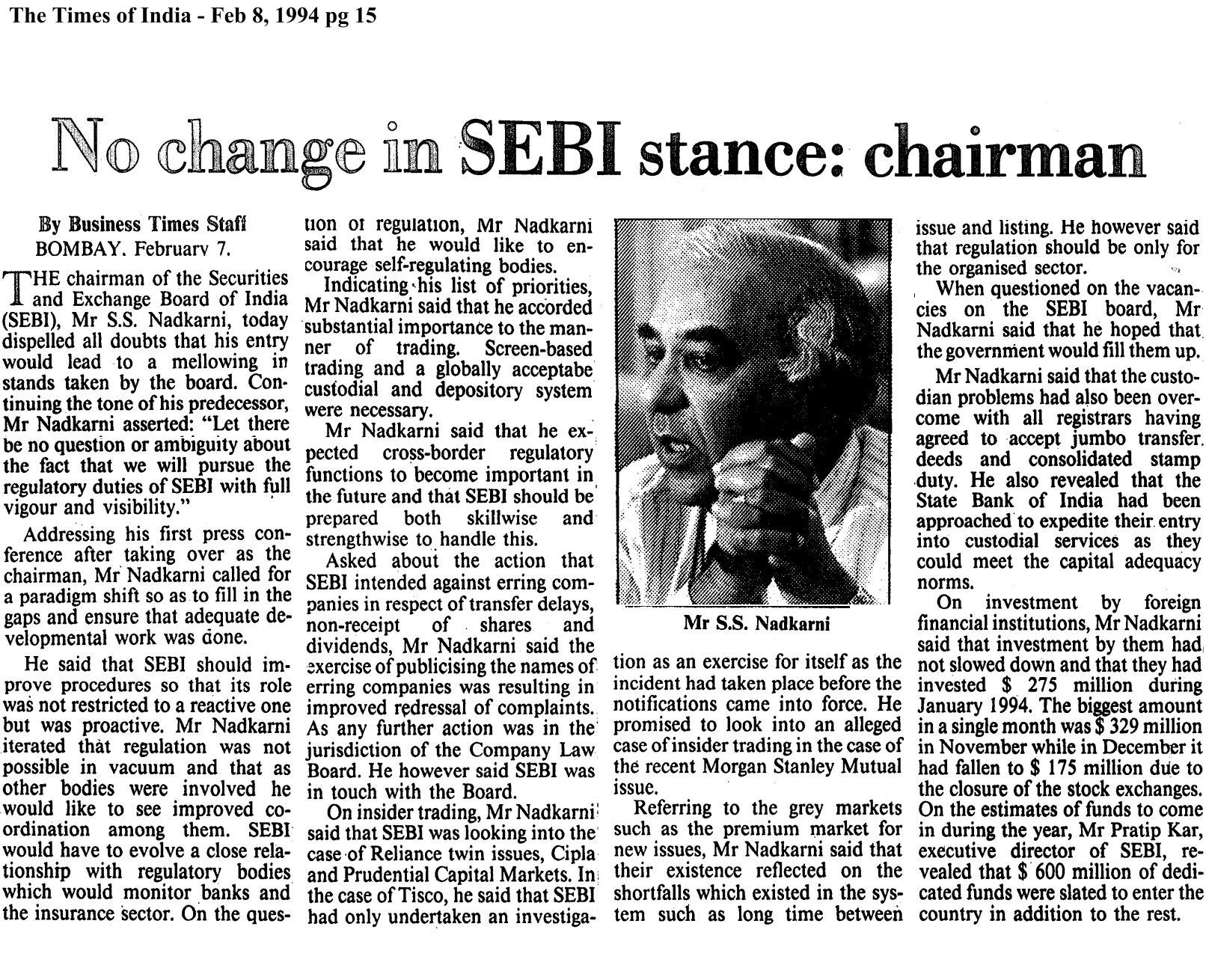

No change in SEBI stance - Chairman

The chairman of Securities and Exchange Board of India (SEBI), Mr S.S Nadkarni, dispelled all doubts that his entry would lead to a mellowing in stands taken by the board. Continuing the tone of the his predecessor, Mr Nadkarni asserted: "Let there be no questing or ambiguity about the fact that we will pursue the regulatory duties of SEBI with full vigour and visibility."

1996 BSE chief takes anouther pot-shot at GVR

Bombay Stock Exchange (BSE) president M.G Damani has launched a renewed attack on former Securities and Exchange Board of India (SEBI) chairman G.V Ramakrishna criticising him for setting up a "casino" to counter the BSE. Reacting to questions on an internet chat show organised by electronic magazine Rediff on the Net, Mr Damani lobbied hard for the expansion of the BSE ON line Trading (BOLT) network outside Mumbai.