Brief Introduction of Debt Markets

Capital market comprises of equities market and debt market. The debt market is a market for the issuance, trading and settlement in debt instruments of various types. The debt market provides a platform for governments and corporations to raise funds in a cost-effective manner. Debt instruments, or fixed income securities, are of various types like Bonds, Debentures, Commercial Papers, Certificates of Deposit, Government Securities, etc issued by a wide range of organizations, like the Central and State Governments, statutory corporations or bodies, banks, financial institutions and corporate bodies. In terms of market share, G-Secs constitute 45.2% of the market share in terms of outstanding bonds at the end of March 2023, followed by State Development Loans (SDLs) (24.9%), corporate bonds (21.8%), T-bills (4.3%), Float Rate Bonds (2.4%) and other (1.5%).

The Government Securities market, or the 'G-Sec' market, is the oldest and the largest component of the Indian debt market in terms of market capitalization, outstanding securities and trading volumes. Besides G-Sec market, there is an active market for corporate debt papers in India which trades in long term instruments, such as debentures, bonds, zero coupon bonds and short term instruments, such as commercial papers issued by, corporates and NBFCs and certificate of deposits issued by banks, etc.

The Government Securities market, or the 'G-Sec' market, is the oldest and the largest component of the Indian debt market in terms of market capitalization, outstanding securities and trading volumes. Besides G-Sec market, there is an active market for corporate debt papers in India which trades in long term instruments, such as debentures, bonds, zero coupon bonds and short term instruments, such as commercial papers issued by, corporates and NBFCs and certificate of deposits issued by banks, etc.

While Government Securities are regulated by the RBI, the issue of non-government securities is regulated by SEBI. The company which is planning to raise funds through corporate bonds offers a public issue or a private placement. In a public issue, company has to issue a prospectus before issuing the bonds.

After the public issue, these bonds are listed on a recognized stock exchange in India. Like equity, the debt market can also be classified into Primary Debt Market and Secondary Debt Market based on its activity.

The public offering by the company is referred to as primary market and the trading of the bonds subsequently through the exchange is called secondary market. While in primary market , investors buy directly from the company, in secondary markets , investors buy the bonds from sellers who wish to sell these bonds.

Indian corporate debt market is gradually increasing its prominence over the years and is evolving as an alternate funding mechanism for corporates/other entities.

Read Articles

View All

Provisions Pertaining to the Denomination of Issuance and Trading of Non-Convertible Securities

In order to enhance ease of doing business and to give impetus to the secondary market for corporate bonds through increased participation and enhancement of liquidity, SEBI in August 2021 prescribed provisions pertaining to the denomination of issuance and trading of non-convertible securities and also reduced the face value of each debt security or non-convertible redeemable preference share issued on a private placement basis from ₹10 lakh to ₹1 lakh vide circular dated October 28, 2022.

Request for Quote (RFQ) platform

To bring in transparency in the bilaterally negotiated ‘Over the Counter’ deals and to improve liquidity and price discovery in the corporate bond market in India, BSE and NSE have launched their Request for Quote (RFQ) platforms. RFQ is an electronic platform that enables multilateral negotiations to take place on a centralized online trading platform with straight through processing of clearing and settlement to complete trades. These platforms act as single interface for price givers and price takers in the debt market from a diverse set of clients, which can result in better price discovery and bring pre-trade transparency to the transactions of eligible securities.

Additional Tier 1 Instruments - Guidelines for Issuance, Listing and Trading

Additional Tier-1 (AT-1) bonds are a type of perpetual bond issued by banks and non-banking finance companies to raise capital and comply with Basel III norms. SEBI vide circular, dated October 6, 2023, issued guidelines for issuance, listing and trading of perpetual non-cumulative preference shares and innovative perpetual debt instruments / perpetual debt instruments (commonly referred to as additional tier 1 (AT 1) instruments or bonds).

Municipal Bonds - Participation of FPIs

As a measure to broaden the access of non-resident investors to debt instruments in India, Foreign Portfolio Investors (FPI) are permitted to invest in municipal bonds.

Prudential investment limits for instruments such as Additional Tier I (AT-I) bonds and Tier 2 (AT-II) bonds

SEBI issued a circular on the Review of Norms regarding Investment in Debt Instruments with Special Features and the Valuation of Perpetual Bonds on March 10, 2021. Perpetual bonds or Additional Tier I Bonds are issued without any maturity date but are usually issued with call option(s) and qualify for Tier I capital. Banks have been the majority issuers of perpetual bonds.

Direct Trade by FPIs in Corporate Bond market

Category I and Category II FPIs were given the option to directly access corporate bond markets without brokers, as has been allowed to banks, insurance companies, pension funds, etc.

Overview of Debt Market

Capital market comprises of the equities market and the debt market. The debt market is a market for the issuance, trading and settlement of debt instruments of various types. The debt market provides a platform for governments and corporations to raise funds in a cost-effective manner.

Potential Risk Class Matrix for Debt Schemes

SEBI mandated the classification of debt schemes based on a risk-class matrix, reflecting the maximum risk fund managers can undertake in schemes. Effective from December 01, 2021, this matrix considers parameters like Macaulay Duration for interest rate risk and credit risk value for credit risk.

Introduction of Expected Loss Based Rating Scale

To standardise the usage of rating scales, Credit Rating Agencies (CRA) were advised to align their rating scales with the rating scales prescribed under the guidelines of the respective financial sector regulator or authority in terms of Regulation 9(f) of SEBI CRA Regulations, or in the absence of the same, to follow rating scales prescribed by the Board from time to time. Further, a seven-point Expected Loss (EL)-based rating scale was introduced to be used by CRAs for ratings of projects/ instruments associated with the infrastructure sector to begin with.

Guidelines on valuation of money market and debt securities

SEBI vide various circulars had prescribed the guidelines on valuation of money market and debt securities. On September 24, 2019, SEBI issued a circular reviewing the existing provisions made in various circulars in order to align these guidelines with best practices and improve the robustness of the valuation of money market and debt securities

View Images

View All.png)

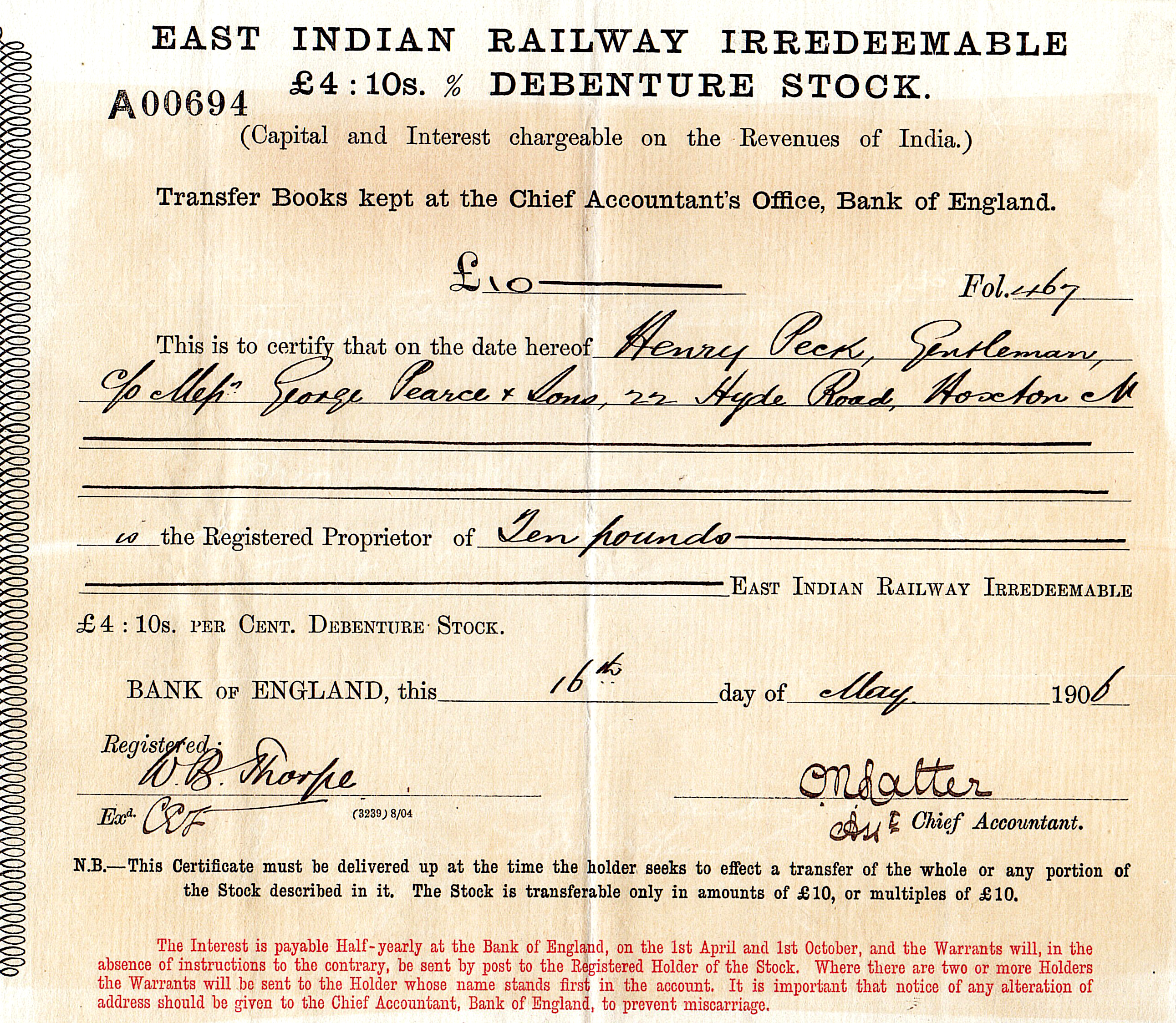

Early debt instruments issued by the English East India Company

“The 1700s: Calcutta's Entrepreneurial Operations. In the 1700s, Calcutta's vibrant marketplace came to life as a hub for traders and goods, setting the stage for future economic endeavours.. 1769: The Rise and Fall of EIC Shares. In 1769, British East India Company shares experienced dramatic fluctuations, reflecting the profound influence of the company on financial markets and marking a pivotal moment in economic history.. 1832-33: Pioneering Early Debt Instruments by the English East India Company. During these years, the English East India Company blazed a trail by introducing early debt instruments, a ground breaking approach to securing capital for ambitious ventures.. The 1850s: Formative Years - The Bombay Green and the Town Hall with Banyan Tree and Brokers. Amidst the bustling Town Hall, the iconic Banyan Tree provided the backdrop for Bombay's formative years in the 1850s, where brokers forged deals and commerce thrived.. 1875-2018: East India Company Trading with Indian Kings and Nawabs in 1805. The East India Company's trading partnerships with Indian royalty in 1805, revealed the intricate interplay between trade, diplomacy, and culture, a legacy that persisted into the modern era.”.

Dibru Sadiya Tea Company Limited

Courtesy: From the collection of security certificates owned by Mr Sayeed Cassim, Ms Maleeha Cassim, Ms Misbah Cassim, Mr Adil Cassim of the Cassim family Chennai

The Madras and Southern Mahratta Railway Company Limited

Courtesy: From the collection of security certificates owned by Mr Sayeed Cassim, Ms Maleeha Cassim, Ms Misbah Cassim, Mr Adil Cassim of the Cassim family Chennai

The Commissioners For The port of Calcutta

Courtesy: From the collection of security certificates owned by Mr Sayeed Cassim, Ms Maleeha Cassim, Ms Misbah Cassim, Mr Adil Cassim of the Cassim family Chennai

The Jubbulpore Portland Cement Company Limited

Courtesy: From the collection of security certificates owned by Mr Sayeed Cassim, Ms Maleeha Cassim, Ms Misbah Cassim, Mr Adil Cassim of the Cassim family Chennai

Chowringhee Properties Limited

Courtesy: From the collection of security certificates owned by Mr Sayeed Cassim, Ms Maleeha Cassim, Ms Misbah Cassim, Mr Adil Cassim of the Cassim family Chennai

India Ceneral Navigation and Railway Company Limited

Courtesy: From the collection of security certificates owned by Mr Sayeed Cassim, Ms Maleeha Cassim, Ms Misbah Cassim, Mr Adil Cassim of the Cassim family Chennai

The Great Western Hotel Company Limited

Courtesy: From the collection of security certificates owned by Mr Sayeed Cassim, Ms Maleeha Cassim, Ms Misbah Cassim, Mr Adil Cassim of the Cassim family Chennai

Royal Bombay YachtClub

Courtesy: From the collection of security certificates owned by Mr Sayeed Cassim, Ms Maleeha Cassim, Ms Misbah Cassim, Mr Adil Cassim of the Cassim family Chennai

East Indian Railway Irredeemable £ s Debenture Stock

Courtesy: From the collection of security certificates owned by Mr Sayeed Cassim, Ms Maleeha Cassim, Ms Misbah Cassim, Mr Adil Cassim of the Cassim family Chennai