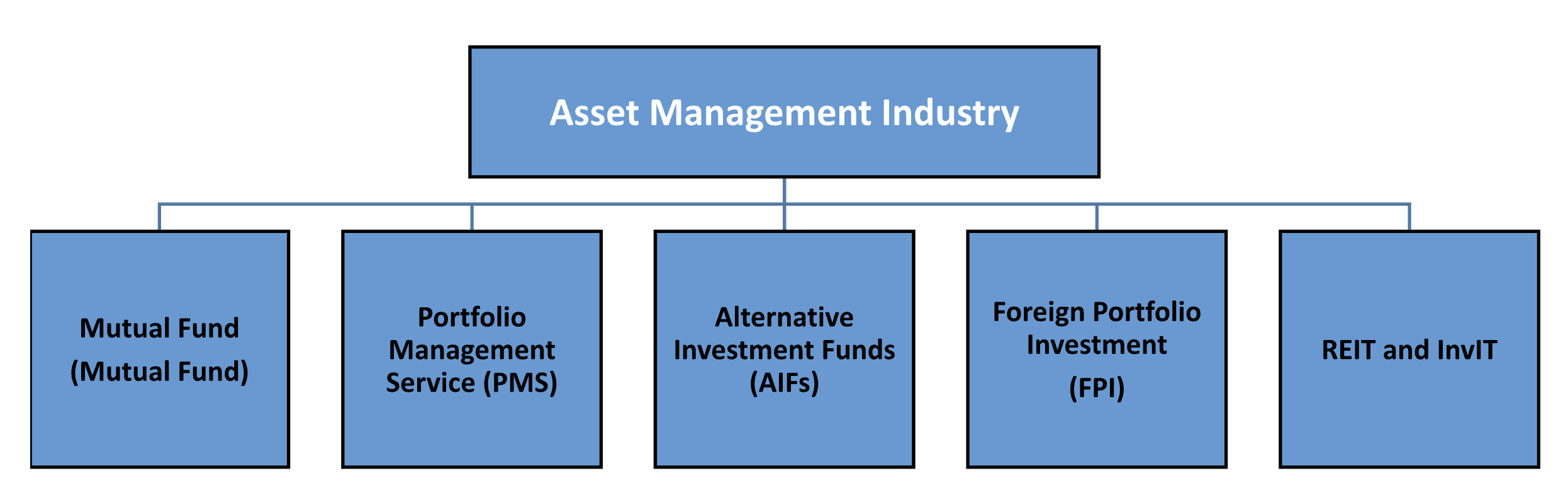

Brief Introduction of Investment Management

Asset management broadly refers to professionals assisting investors to invest in varied asset classes like equity, debt, etc, with the objective to earn profit, dividend, and interest on their investment. The goal of asset management is to maximize the value of an investment portfolio over time while maintaining an acceptable level of risk. Asset managers have fiduciary responsibility as they make decisions on behalf of their clients and are required to do so in good faith. Rising financial awareness, robust regulatory framework and financial technology has propelled the evolution of Indian asset management industry over the years as a popular mode for wealth creation for individual and institutional investors.

Asset Management can be broadly classified into following segments

Mutual Fund is an investment vehicle (in the form of trust) that assists investors to invest in various products like stocks, bonds, short-term debt, hybrid securities, ETFs etc through specific mutual fund schemes. Investors can invest in any of the mutual fund schemes based on their investment objective (can be for education, wealth creation, saving tax etc) and risk taking capacity. As of November 2023, there are 43 registered Asset Management Companies (AMCs) in India, who have collectively launched about 1472 mutual fund schemes. Assets under Management (AUM) of mutual fund industry in India has grown from Rs. 7 lakh crore in March 2013 to Rs. 49 lakh crore as of end November 2023. Accelerated geographical penetration of mutual funds is expected to channelize more household savings to securities market in the future.

Portfolio Management Service or PMS is a professional financial service where skilled portfolio managers and stock market professionals manage investment portfolio of their clients with the assistance of a research team. As of November 2023, there are 406 Portfolio Managers registered with SEBI, managing assets worth about Rs 30 lakh crore.

Alternative Investment Fund or AIF is a privately pooled investment vehicle which collects funds from sophisticated investors, whether Indian or foreign, for investing it in accordance with a defined investment policy for the benefit of its investors. Alternative investments can invest in both listed and unlisted stocks. As of November 2023, there are around 1188 AIFs registered with SEBI. Until June 2023, AIFs had cumulatively raised commitments of Rs.8 lakh crore and made investments of Rs.3.5 lakh core. The growth of AIF industry is expected to continue as it is suitable vehicle to channelize funds of sophisticated investors.

FPI The foreign portfolio investment allows foreign nationals to invest in Indian securities like stocks and bonds. Investment in foreign portfolio allows investors to diversify their portfolio and opportunity to earn higher returns, depending on the growth potential of the country. As of November 2023, there are more than 11,000 FPIs registered with SEBI for investment in India, holding total investment of Rs. 56 lakh crore.

REIT & InvIT Real Estate Investment Trust (REIT) is an investment trust that pools money from a number of investors to invest in investment grade and income/ rent-generating real-estate properties such as offices, malls, industrial parks, etc. Infrastructure investment trusts (InvIT) are almost same like REITs, except they invest in infrastructure projects such as roads or highways which generate steady cash flows in terms of toll collections. As of March 2023, there are 5 REITs and 23 InvITs registered with SEBI. Going forward, REITs and InvITs are expected to be key vehicles for infrastructure financing and monetisation of real estate and infrastructure assets.

Read Articles

View All

Conversion of Private Unlisted InvIT into Private Listed InvIT

SEBI vide circular dated February 9, 2022 prescribed framework for conversion of private unlisted InvIT into private listed InvIT.

Participation of Mutual Funds in Commodity Derivatives Market in India

In order to enhance liquidity & depth for efficient price discovery and price risk management in commodity derivatives segment, various committees including those constituted by the Government of India have recommended participation of institutional investors in the commodity derivatives markets. Taking cognizance of the fact that participation by institutional investors and based on the recommendation of the Commodity Derivatives Advisory Committee (CDAC), SEBI allowed Category III Alternative Investment Funds, Mutual Funds and Portfolio Management Services to participate in ETCDs with certain conditions prescribed vide Circular dated June 21, 2017. The sub-group of CDAC recommended the opening of ETCDs to other institutional investors in a phased manner. In phase I, Category III Alternative Investment Fund (AIF), Portfolio Management Services (PMS), Mutual Funds, direct participation of foreign participants having exposure to commodities were allowed and in Phase II, Banks, Insurance/reinsurance companies, Foreign Portfolio Investors (FPIs), Pension Funds were permitted. While Category III AIFs were already permitted, the participation by Mutual funds and FPIs was permitted subsequently vide circular dated April 26, 2019 and September 29, 2022, respectively.

Trading in Public Sector Bonds & Units of Mutual Funds - Shri S S Nadkarni

The Reserve Bank of India formed a committee under the chairmanship of Shri S S Nadkarni to enhance the process for transactions in public sector bonds (PSU Bonds) and mutual fund units. It was also required to recommend the modalities of an alternative system covering the booking of transactions and efficient methods of accounting and transfers. The recommendations involve establishing an organized market arrangement for fixed yielding securities and an electronic book entry clearing facility supported by a depository.

Introduction of Swing Pricing Framework for Open-Ended Debt Mutual Fund Schemes

In the case of mutual funds, the mechanism of swing pricing is intended to protect existing investors of a fund from the costs incurred when other investors buy or sell units in that fund. In cases of severe liquidity stress at the AMC level or severe dysfunction at the market level, the Swing Pricing Guidelines gets triggered, which offer a contingency plan in case everything else fails. SEBI, on September 29, 2021 issued the swing pricing framework for open-ended debt mutual fund schemes, except overnight funds, gilt funds, and gilt with 10-year maturity funds. However, based on the request received from AMFI, the date for implementation of the provisions of the aforesaid circular was postponed to May 1, 2022.

Resident Indian Fund Managers to be Constituents of FPIs

The Finance Act 2020 amended Section 9A of the Income Tax Act, 1961, enabling resident Indian fund managers, beyond individuals, to be constituents of Foreign Portfolio Investors (FPIs). This amendment, along with amendments to SEBI regulations, aims to encourage Indian fund managers to contribute seed capital to offshore investment funds, fostering new business opportunities.

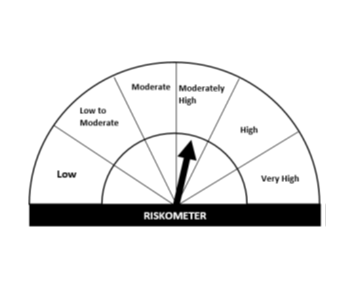

Product Labelling in Mutual Fund Schemes – Risk-o-Meter

In the context of earlier SEBI circulars ‘Product Labelling in Mutual Funds’ and based on the recommendations of the Mutual Fund Advisory Committee (MFAC), SEBI reviewed the guidelines for product labelling in mutual funds.

Instant Access Facility (IAF) in Mutual Funds

The Instant Access Facility (IAF) enables mutual fund investors to quickly access their invested funds in specific schemes. It ensures that redemption proceeds are credited to the investor's bank account on the same day the redemption request is made. This facility aims to provide investors with quick access to their investments (up to a certain limit) to address urgent financial needs.

Disclosure-based Framework for FPIs

Certain FPIs have been observed to hold a concentrated portion of their equity investments in single Indian companies or corporate groups, raising concerns about regulatory circumvention. Identifying beneficial owners of FPIs remains difficult due to fragmented ownership. New SEBI regulations mandate detailed disclosures on persons having any ownership, economic interest, or control in FPIs with significant Indian equity holdings to ensure market stability and transparency.

Mutual Funds were allowed to invest in hybrid securities such as units of REITs and InvITs

In terms of SEBI (Mutual Funds) (Amendment) Regulations, 2017 dated February 15, 2017 and SEBI Circular dated February 28, 2017, mutual funds were allowed to invest in hybrid securities such as units of REITs and InvITs subject to investment restrictions. Any existing scheme intending to invest in units of REITs/InvITs would have to abide by the provisions of Regulation 18 (15A) of SEBI (Mutual Funds) Regulations, 1996. For investment in units of REITs/InvITs by an existing MF scheme, unit holders of the scheme were given a time period of at least 15 days for the purpose of exercising the exit option. In accordance with SEBI (Mutual Funds) (Amendment) Regulations, 2017 dated February 15, 2017 and SEBI Circular dated February 28, 2017, the Mutual Fund under all its schemes shall not own more than 10% of units issued by a single issuer of REIT and InvIT. At a single Mutual Fund Scheme level, it shall not own: i. more than 10% of its NAV in the units of REIT and InvIT; and ii. more than 5% of its NAV in the units of REIT and InvIT issued by a single issuer. Depending on the development of the market, the internal investment norms are required to be submitted to the Board of AMC for approval before making any investment in units of REITs/InvIT. For further details, please see the SEBI circular SEBI/HO/IMD/DF2/CIR/P/2017/17 dated February 28, 2017.

Launch of Investor Risk Reduction Access Platform

During instances of technical glitches in trading members ‘systems, if both the primary and DR sites are affected and regular business cannot be conducted, affected Trading Members' investors can exit or square off their outstanding positions using a common platform called Investor Risk Reduction Access (IRRA), jointly provided by all exchanges. IRRA has been jointly developed by all the stock exchanges: BSE (Bombay Stock Exchange), NSE (National Stock Exchange), NCDEX (National Commodity and Derivatives Exchange), MCX (Multi Commodity Exchange) and Metropolitan Stock Exchange of India (MSE)

View Images

View All

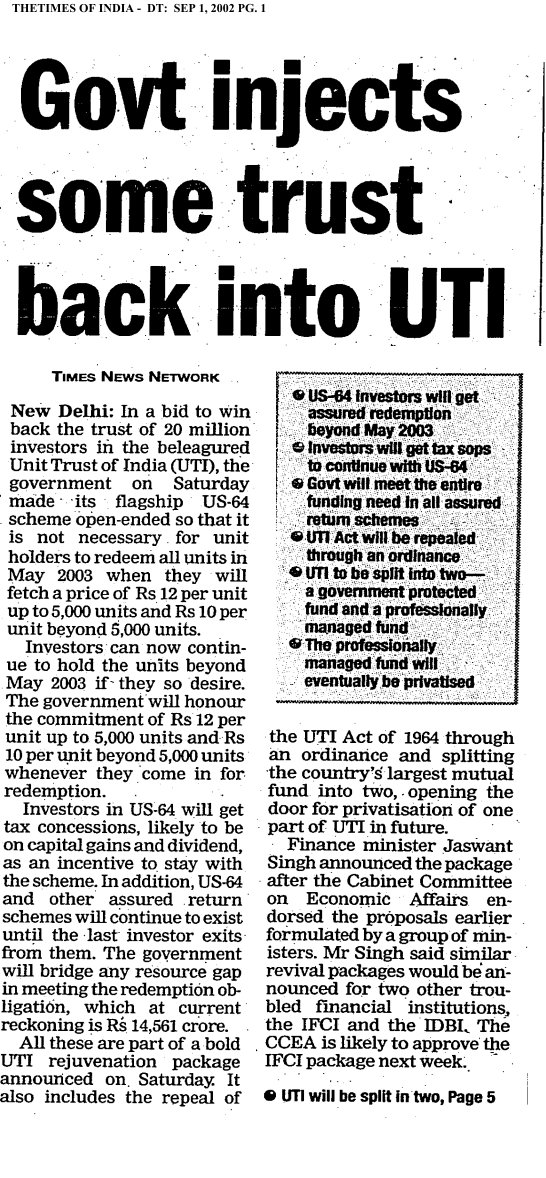

Govt injects some trust back into UTI

In a bid to win back the beleaguered Unit Trust of India (UTI), the government made its flagship US-64 scheme open ended so that it is not necessary for unit holders to redeem all units when they will fetch a price of Rs 12 per unit up to 5000 units.

Govt spells out sweeteners in UTI pill

The government decided that UTI would not sell its equity holdings to meet its redemption obligations arising out of assured return schemes. The decision was taken to send the right signal to investors.

Stock market stable despite UTI change

Dalal Street which suffered a setback in kerb trading on Friday, March 30, 1990 evening, following the announcement that Mr. M J Pherwani has proceeded on leave and Dr. S.A Dave, chairman of the Securities and Exchange Board of India (SEBI) had taken over as chairman od UTI, exhibited , steady conditions in kerb deals on Saturday.