Read Articles

D C Anjaria Committee on Review of SEBI Fee Structure for Stock Brokers

The fee structure for the brokers prescribed in the regulations was based on the recommendations made way back in 1992 by the R S Bhatt Committee. The recommendations of the Committee were based on the then level of brokerage earned by the brokers. Over the next decade, the market structure witnessed sea change, which coupled with fierce competition among brokers, has brought down the level of brokerage drastically. This necessitated a review of the fee structure for the stock brokers. Accordingly, on January 21, 2002, SEBI constituted a Committee under the Chairmanship of Mr. D. C. Anjaria to review the fee structure for the stock brokers. The Committee submitted its report during November 2003.

SEBI - An Evolution of Legislative Empowerment

The article traces the evolution of SEBI from its conceptualization in the G.S. Patel Committee Report, 1985 to its establishment in the year 1988, its empowerment through legislation as a statutory body in the year 1992 and beyond. Accordingly, this article highlights the salient features of Acts such as the SEBI Act, 1992, the Depositories Act, 1996, the Securities Contracts [Regulation] Act, 1956, and the Companies Act, 2013. The article also delves into the details of the important legislative empowerment of SEBI through legislative amendments in the years 1995, 1999, 2002, 2004, 2014, 2015 and 2019.

Watch Videos

Nehal Vora - Interview

Interview with Shri Nehal Vora, MD and CEO of CDSL: Discover how decades of SEBI-led reforms turned a 19th-century, floor-traded market into a fully digital, AI-enabled ecosystem. Whether you’re an investor, policymaker or fintech enthusiast, this conversation with Shri Nehal Vora charts India’s unique journey from paper to pixels and previews what’s next for inclusive capital-market growth.

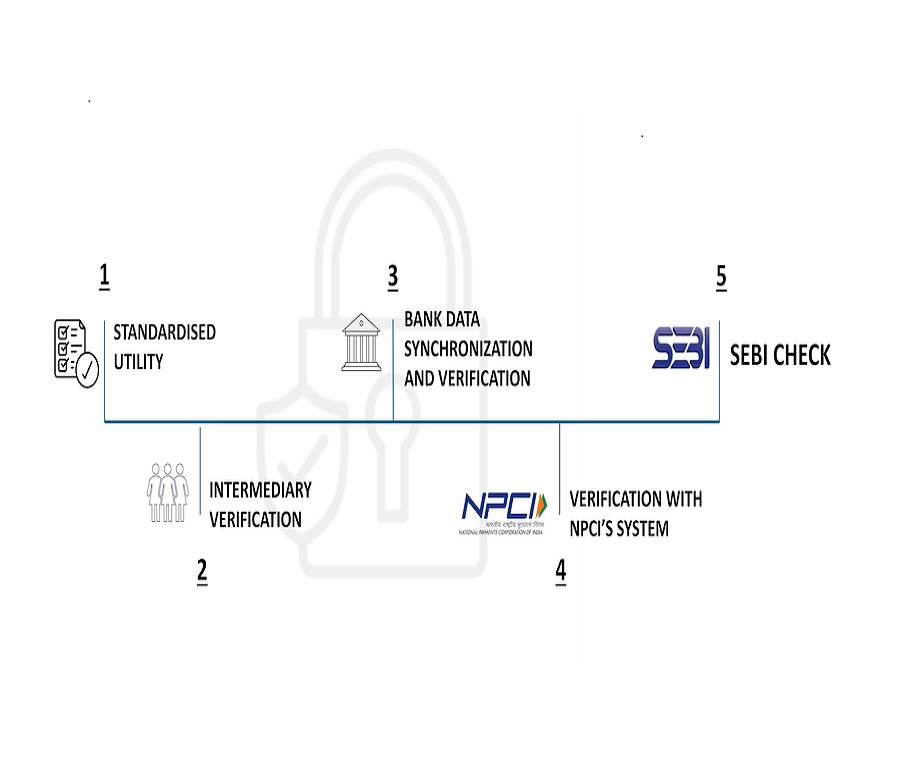

SEBI Introduced Validated UPI Handles and SEBI Check

SEBI announced a significant initiative to enhance investor protection and combat unauthorized money collection in the securities market. Effective October 1, 2025, SEBI will introduce a structured and validated UPI address mechanism, featuring the exclusive valid handle, for all SEBI-registered investor-facing intermediaries.

Application Supported by Blocked Amount in Secondary Market

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack

Central Demise Reporting

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack

Security and Covenant Monitoring Platform

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack

Software as a Service

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack

Investor Risk Reduction Access

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack

Logging and Monitoring Mechanism

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack

Application Supported by Blocked Amount ASBA in Primary Market and Listing in T+3

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack

Equity T+1 and Beta version of T+0 settlement cycle

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack

View Images

SEBI clears first ever exchange traded fund

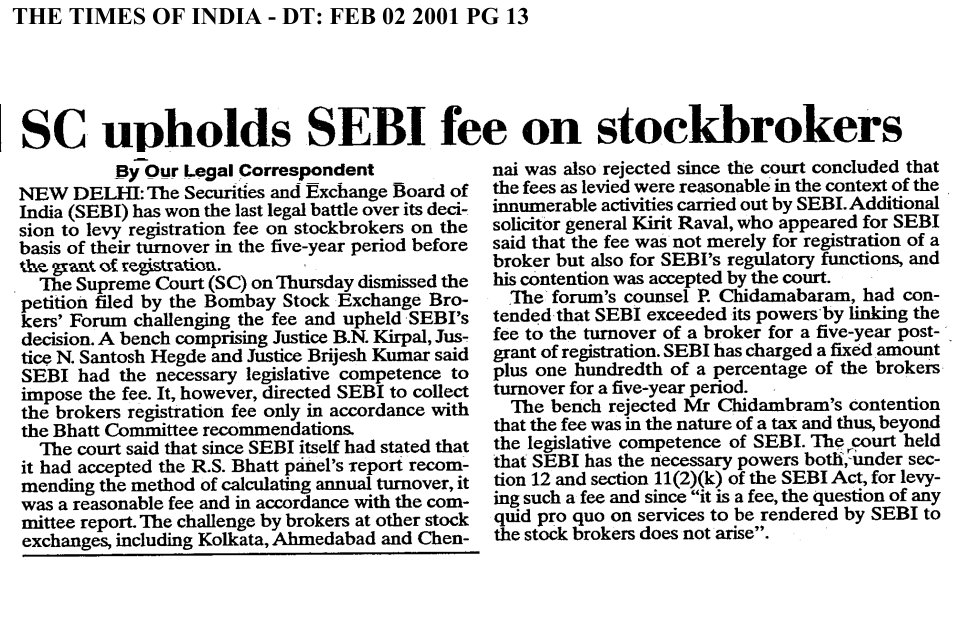

The Securities and Exchange Board of India (SEBI) has won the last legal battle over its decision to levy registration fees on stockbrokers on the basis of their turnover in the five-year period before the grant of registration. The Supreme Court dismissed the petition filed by the BSE Brokers' Forum challenging the fee and upheld SEBI's decision.

.png)

British East India Company, 1600-1874

"Founded on December 31, 1600, the British East India Company (EIC) held a pivotal role in the annals of global trade. Its joint stock shares were traded in London, consistently providing dividends until its dissolution in 1874. East India House, established in the 1720s, embodied the essence of EIC's operation. This unassuming yet bustling hub in London became the epicenter of early global commerce and finance for almost two centuries. Within its walls, momentous decisions were made. EIC, dealing in goods such as tea, spices, and textiles, charted treacherous seas and intricate trade networks, reaping profits and inviting controversy. The company's ships sailed to distant shores, impacting the course of history by shaping trade routes and influencing world events. East India House isn't adorned with the grandeur of palaces; instead, its halls resonate with tales of ambition, rivalry, and, occasionally, exploitation. This historic site embodies how business interests could profoundly shape the world. The museum plaque here commemorates a chapter where trade and finance converged, sometimes for the better, and at times, for the worse."

.png)

A Journey from Dutch Ventures to India's Commerce

"1861-64: Dalal Street Bombay - The Fort Area Where Brokers Carried Business. In the heart of Bombay, the bustling Dalal Street took shape in the 1860s, serving as a pivotal financial district where brokers conducted business. The 1880s: The Evolution of the BSE Logo from Inception to Present. The 1880s marked a transformative phase for the Bombay Stock Exchange's iconic logo, symbolizing its enduring presence in the financial landscape. The 1900s: Original Location of the 'Neem Tree' with Traders Doing Business. Throughout the 20th century, the 'Neem Tree' stood as a symbol of commerce, witnessing traders conducting business beneath its branches, capturing the essence of traditional Indian trade. The 1900s: BSE Building Reconstruction - Melding the Old with the New. In this century, the Bombay Stock Exchange's building underwent a significant transformation, seamlessly blending the old with the new, signifying continuity in a changing world. 1908: The Old Building of Calcutta Stock Exchange. In 1908, the Old Building of the Calcutta Stock Exchange served as a testament to India's enduring financial heritage.”

.png)

Early debt instruments issued by the English East India Company

“The 1700s: Calcutta's Entrepreneurial Operations. In the 1700s, Calcutta's vibrant marketplace came to life as a hub for traders and goods, setting the stage for future economic endeavours.. 1769: The Rise and Fall of EIC Shares. In 1769, British East India Company shares experienced dramatic fluctuations, reflecting the profound influence of the company on financial markets and marking a pivotal moment in economic history.. 1832-33: Pioneering Early Debt Instruments by the English East India Company. During these years, the English East India Company blazed a trail by introducing early debt instruments, a ground breaking approach to securing capital for ambitious ventures.. The 1850s: Formative Years - The Bombay Green and the Town Hall with Banyan Tree and Brokers. Amidst the bustling Town Hall, the iconic Banyan Tree provided the backdrop for Bombay's formative years in the 1850s, where brokers forged deals and commerce thrived.. 1875-2018: East India Company Trading with Indian Kings and Nawabs in 1805. The East India Company's trading partnerships with Indian royalty in 1805, revealed the intricate interplay between trade, diplomacy, and culture, a legacy that persisted into the modern era.”.

Govt gives SEBI an overhaul, more teeth

The Government of India, decided to empower the stock market regulator, SEBI, by giving it more teeth for investigation, including power of search and seizure. The decision was made due the episodes of market misconduct which showed the limitations of SEBI Act.

.png)

Dutch East India Company Bond, dated 7th November, 1623

‘Early Trading Companies’ Two pioneering trading companies, the Dutch East India Company and the British East India Company, hold an esteemed place in the annals of financial history. In 1602, the Dutch East India Company, established with exclusive rights to East Indies trade, initiated a momentous event—the world's first Initial Public Offering (IPO). This ground breaking offering heralded the birth of stock exchange trading, setting in motion a transformation in global commerce and investment. The British East India Company, founded on December 31, 1600, played a monumental role in the history of trade. Its joint stock shares were actively traded in London, signifying a burgeoning capital market. Notably, this enterprise consistently paid dividends to its investors, exemplifying reliability over centuries until its dissolution in 1874. In parallel, early debt instruments issued by the English East India Company, a predecessor to its British counterpart, demonstrated ingenuity in raising capital for ambitious ventures. These innovations in finance pushed the boundaries of what was conceivable in the realm of commerce. Together, these historical facts epitomize the genesis of modern financial systems. From the inaugural Dutch IPO, symbolizing the birth of stock exchange trading, to the British East India Company's unwavering dividends and inventive debt instruments, these companies laid the foundation for the contemporary financial markets we know today.

SC upholds SEBI fee on stockbrokers

The Securities and Exchange Board of India (SEBI) has issued show-case notices to the top brass of the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) for their failure to detect and check price manipulation in three scripts, in its notice dated February 10, SEBI asked to explain lapses in detecting the abnormalities in price and volume in the scrips-Sterile Industries, BPL Ltd and Videocon Industries.

Central Depository be a reality soon

Last minute touches were given to the custodial and depository services bill, which is certain to be introduced during the monsoon session of Parliament, an official source said.

SEBI becomes members of IOSCO w.e.f. September 18, 1989

The Securities and Exchange Board of India has become a member of the Montreal-based International Organisation of Securities Commissions (IOSCO) with effect from September 18, 1989. This was the first time that India has been represented at this important international organisation.

Flag off derivatives with index futures: SEBI panel

The secondary market advisory committee of the Securities and Exchange Board of India, in its meeting here on Monday, April 20, 1998 discussed the Dr. L. C. Gupta committee recommendations on derivatives trading and agreed that derivatives should be introduced in a phase manner, beginning with index future.

.png)