Article Repository

Content Type

Category

Sort

The commodity trading has witnessed transformative shifts over the centuries. Ancient Mesopotamian clay tablet contracts established the foundation for commodity derivatives. Historical developments, from Japan's Dojima Rice Exchange to Chicago's CBOT, shaped commodity markets. In modern India, trading occurs on electronic platforms of recognized exchanges, namely MCX, NCDEX, NSE and BSE. The Emergence of nation-wide electronic trading facilities offered by national-level exchanges and certain regulatory requirements led to the closure of smaller or commodity specific exchanges. Over a period, the market regulator, (earlier Forward Market Commission and now SEBI) introduced several measures from time to time to deepen and broaden the market.

The article titled “Indian Stock Market: Formative Years” provides a brief outline of the landmark events that are strongly etched in the historical timeline for the foundation of the securities market in India since the 17th century.

Rain gambling, or "Barsat ka Satta", originated in Rajasthan, where the Marwari community, facing perennial water scarcity, speculated on monsoon patterns. It spread to Calcutta (now known as Kolkata) in the 1800s, faced British opposition in Bombay (now known as Mumbai), and led to a court victory for Marwari rain gamblers. Despite protests, legislative amendments caused its decline and eventual ban in Calcutta by 1900. This unique chapter in gambling history reflects human adaptability amid monsoon unpredictability, serving as a nostalgic reminder of India's early weather derivatives.

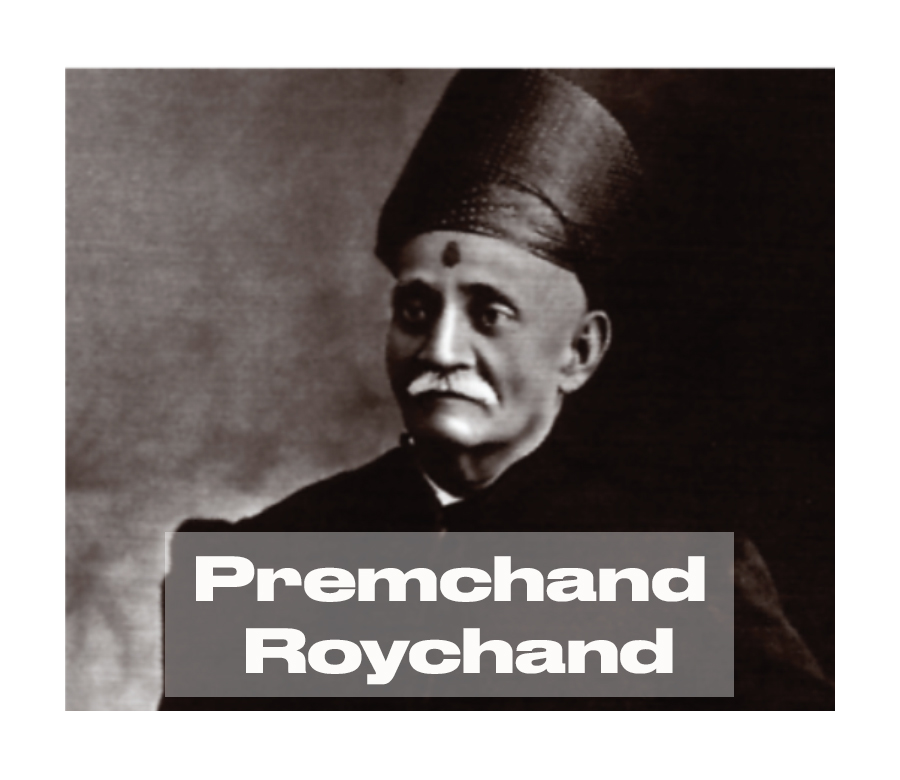

During the 19th century, Shri Premchand Roychand was a prominent personality in financial market in Mumbai (earlier known as Bombay). Born in 1831, he rose from a modest background to become a key player in the stock market, ultimately founding the ‘The Native Share and Stock Brokers Association (later known as Bombay Stock Exchange and now BSE). His career coincided with a period of economic growth in Mumbai, driven by factors like the American Civil War's impact on the cotton trade. Premchand's influence extended to banking and land reclamation projects, marking stages of prosperity. However, the end of the Civil War led to a financial downturn, and he faced criticism and financial ruin. Despite this, Premchand Roychand's legacy endures through his philanthropic contributions and the recognition of his impact on Mumbai’s development. A dedicated gallery in Chhatrapati Shivaji Maharaj Vastu Sangrahalaya, Mumbai, has been established in his honor. The University of Calcutta gives out an award in his name i.e. Premchand Roychand Award to an outstanding student in Master of Arts every year. The Rajabai clock tower in Mumbai is named after his beloved mother, Rajabai Roychand.

This article explores the historical evolution and significance of Indian Companies Acts from 1850 to 2013 in shaping corporate governance and the securities market in India. It highlights key milestones in the development of company laws, such as limited liability, mandatory audits, financial disclosures and the establishment of regulatory bodies like SEBI. The article also discusses the impact of these acts on corporate governance practices, transparency, accountability, and investor protection. It emphasizes how these legal frameworks have facilitated economic growth and attracted investment, with iconic companies benefiting from the evolving regulatory environment. The Companies Act of 2013, with its modernization efforts, is seen as a turning point in promoting a transparent and investor-friendly corporate environment.

This article explores the celebrated history of the Calcutta jute industry, tracing its roots, its hegemony in the world markets and its decline. Starting in 1855 with the Acland Mill in Rishra, Bengal, the jute industry experienced significant growth under the managing agency system. The Indian Jute Manufacturers Association (IJMA), formed in 1884, fuelled the prosperity of the industry until the end of World War I. The article goes on to explain how Calcutta outstripped Dundee and Scotland to become the capital of the global jute markets and the ensuing boom in the jute shares market. It also discusses how the emergence of jute substitutes, the age-old policies of IJMA and finally the partition of British India led the industry onto the path of decline. The article concludes by emphasizing the potential of jute as a sustainable and eco-friendly crop that could play a significant role in the world of tomorrow.

“… 50 million sterling, if not more, of real wealth had been allowed to disappear like the baseless fabric of a vision, and how on the debris of such fabric the Bombay (now known as Mumbai) of today was re-built…”- DE Wacha, A Financial Chapter in the History of Bombay City. The American Civil War, which took place from 1861 to 1865, had a profound impact on global cotton supplies. Amidst the crisis, India emerged as a crucial alternative source of cotton for the textile mills of Europe. The Bombay Presidency, in particular, played a pivotal role in supplying cotton to meet this growing demand.

The BSE is the oldest stock exchange in Asia and its origins can be traced back to the 1850s. The establishment of the BSE was influenced by various factors related to trade and business in Bombay (now Mumbai), which was a prominent commercial centre during British rule in India.

Over the centuries, commodity trading has evolved from the barter system to spot markets to derivatives markets. In commodity spot markets, traders sell goods such as rice for immediate delivery against cash. At some stage, counterparties needed to enter into agreements to deliver commodities (eg, rice) at a specified time in future at a price agreed today. These agreements came to be known as forward contracts. For example, on April 1, a seller agreed to sell rice of specific quantity for delivery on a future specified date say July 31 to the buyer at pre-decided price, the contract will be honoured by both the parties, irrespective of prevailing price of rice on July 31.

The Ahmedabad Stock Exchange (ASE), the second oldest and one of the prominent regional stock exchanges in India, was established in 1894 and played an important role in facilitating the listing and trading of securities, particularly in Gujarat. The ASE was recognized by the Securities Contract (Regulations) Act, 1956, as a permanent exchange in 1982. However, similar to many other regional stock exchanges, it faced many challenges, such as its inability to evolve with technological advancements, increased competition from the NSE and BSE, and its dwindling trading volumes, post the advent of online trading systems. In 2018, the ASE was formally permitted by SEBI to exit the business of the stock exchange.

Stock Market- A Historical Sketch.jpg)

Calcutta (now known as Kolkata), the political and commercial capital of British India till 1911, boasted a thriving stock market activity that served as the nation's first financial hub. The establishment of the Calcutta Stock Exchange (CSE) was a response to the growing need for an official stock exchange. During its heyday, Calcutta provided a plethora of trading opportunities through three distinct stock exchanges, namely the Calcutta Stock Exchange, the Bengal Share and Stock Exchange, the Stock Exchange Association of Bengal and informal exchanges at Gudri and Katni. However, with the change in time, only CSE continued its operations, and the other exchanges vanished/discontinued their operations. The CSE enjoyed the status of one of the most prominent stock exchanges for a long time and also modernised its operations with the introduction of electronic trading system. However, the challenges emerged from the payment crises of 2001 and the emergence of national-level electronic trading platforms offered by BSE and NSE, as a result of which CSE struggled to keep afloat. This eventually culminated in its trading suspension in 2013.

on Stock Exchanges.jpg)

The history of bank failures dates back to a few centuries but recorded ones are as far back as 17th century. In the early 20th century, the world's financial landscape underwent significant transformation. As nations braced themselves for the impending chaos of World War I, India's economy had to confront multiple challenges. One of the most significant economic events during this period was the series of domestic bank failures between 1913 and 1921, which left an indelible mark on Indian stock exchanges. A notable case during this period was that of a prominent member of the Native Share and Stock Brokers Association (earlier known as Bombay Stock Exchange and now BSE), Mr. Jahangir Byramji, who had a substantial holding in Manekji Petit Mill shares, was adjudicated as an insolvent.

Equity markets comprise of the ecosystem and processes through which, investors buy and sell shares of publicly traded companies and where both listed and unlisted companies raise capital from public or selected shareholders. Equity Shares, or commonly called "shares" or "stocks", represent a portion of ownership in a company. An investor who purchases shares of a company becomes a shareholder, entitling them to a share of the company's profits and potential benefits, such as dividends, capital appreciation (increase in stock value), bonus shares and other corporate actions. .

-A Historical Journey.jpg)

Madras Stock Exchange, established in 1920, was the first in the southern part of India. MSE played a notable role in the growth of industries in the southern region. By observing strict rules of conduct and ensuring high professional standards, MSE earned its esteem among the investing public as well as the entrepreneurs. In 1957, the Exchange registered itself under the Companies Act, 1955 and became a company limited by guarantee. The exchange was converted into a company limited by shares and obtained re-registration on November 18, 2005. MSE ensured to keep up with the technological advancements happening in the sphere of business. However, the expansion of national stock exchanges and the spread of their terminals all over India affected MSE, as did any other regional stock exchange. In 2001, MSE established its subsidiary company, MSE Financial Services Ltd. and acquired membership of NSE and BSE, through a provision provided by SEBI to the regional stock exchanges to revive their business. However, MSE decided to exit the stock exchange arena in 2014 and the same was stamped by the exit order passed by SEBI on May 14, 2015.

The Committee was constituted by Government of Bombay in 1923 under the chairmanship Sir Wilfrid Atlay to enquire into the constitution, customs, rules, regulations and methods of business of the Native Share and Stock Brokers’ Association of Bombay with a view to protecting the investors and formulating future proposals. The Committee found that the Native Share and Stock Brokers’ Association of Bombay was a voluntary association with over 400 members, primarily focused on protecting member interests and providing a market for buying and selling stocks and securities, with rules and regulations regularly updated.

This article outlines the background leading up to the constitution of the Enquiry Committee in 1923 chaired by Sir Wilfrid Atlay to look into the affairs of the functioning of the Native Share and Stock Brokers’ Association in Bombay. The article goes on to describe some of the major observations made by the committee, the issues underlined by the Committee concerning the business of the Association and the important recommendations given by the Committee.

The Great Depression was the deepest and longest economic downturn of the 20th century that affected most of the major economies of the world. India, being a colonial export-oriented economy, was also adversely impacted by the Great Depression, primarily due to a crash in commodity prices in domestic and international markets. Further, stocks plummeted on major Indian exchanges, taking cues from global turmoil. However, by 1932, normalcy was restored in international trade and manufacturing activity and there was a sizable recovery in India as well. The article delves into the events leading to the Wall Street crash of 1929, the subsequent global economic depression, and the impact of these events on the Indian economy.

In 1936, forward trading was suspended. Consequently, the investing public faced huge losses and brought criticism to the exchange. This led to the Governor in Council appointing the Stock Exchange Enquiry Committee under the chairmanship of Walter B. Morison vide a resolution dated November, 24 1936 to examine the workings of the Native Share and Stock Brokers’ Association of Bombay (earlier known as Bombay Stock Exchange and now BSE) and to submit any suggestions for modifications or reorganization of the stock exchange in the interest of investors. The Morison Committee Report is a significant chapter in the history of Indian stock exchanges, shedding light on the initial attempts at reforming and structuring the market for enhanced transparency and investor protection.

The Committee was constituted in 1937 by Government of Bombay with Mr. Walter B Morison as its Chairman. The committee was required to consider whether any modifications in the workings of the Native Share and Stock Brokers' Association were desirable in the interests of the investors and to make recommendations for the same. Some of the key recommendations included limiting powers of intervention by the Board of Directors in the natural course of the market, strengthening rules with regard to defaulters and remisiers, institution of margin deposits and, prohibition of speculative dealings for employees.

The Capital Issue (Control) Act, 1947 was the pivotal act governing the issuance of capital by corporates from 1947 to 1992, until economic reforms and new economic policy in India replaced the remit this piece of legislation with that of the SEBI Act, 1992. This article explores the origin, evolution and role of the Capital Issues (Control) Act, 1947.