Article Repository

Content Type

Category

Sort

The article traces the inception and evolution of the Indian Mutual Fund industry, focusing on the landmark establishment of the Unit Trust of India (UTI) in 1964. Inspired by global models, particularly the Unit Trust of England, UTI emerged as the world's first public sector unit trust with the mission to encourage savings and investment. Spearheaded by Shri T T Krishnamachari, UTI played a pivotal role in channeling small savings from lower and middle-income groups into the capital markets. The narrative explores key milestones, such as the introduction of innovative schemes like Unit Scheme 1964 and the challenges faced by US-64 in later years. The article also highlights the regulatory changes in 1993, the subsequent revamp of UTI in 2003, and its continued growth and adaptability, positioning it as one of India's leading mutual fund houses today.

The Reserve Bank of India formed a committee under the chairmanship of Shri S S Nadkarni to enhance the process for transactions in public sector bonds (PSU Bonds) and mutual fund units. It was also required to recommend the modalities of an alternative system covering the booking of transactions and efficient methods of accounting and transfers. The recommendations involve establishing an organized market arrangement for fixed yielding securities and an electronic book entry clearing facility supported by a depository.

Restriction on redemption in Mutual Funds eased. Extant provisions on restriction of redemption were general in nature and did not specifically spell out the circumstances in which restriction on redemption may be applied, leading to discretionary disclosures and practices in the industry. Therefore, in order to bring more clarity and to protect the interests of the investors, SEBI vide its circular dated May 31, 2016, prescribed that the following should be observed before imposing restrictions on redemptions: a. Restrictions may be imposed when there are circumstances leading to a systemic crisis or event that severely constricts market liquidity or the efficient functioning of markets such as: i. Liquidity Issues - when the market at large becomes illiquid, affecting almost all securities rather than any issuer specific security. Further, restrictions on redemption is not allowed in instances where a specific security becomes illiquid in the portfolio of scheme due to a poor investment decision. ii. Market Failures, Exchange Closures - when markets are affected by unexpected events that impact the functioning of exchanges or the regular course of transactions. iii. Operational Issues - when exceptional circumstances are caused by force majeure, unpredictable operational problems and technical failures (for example, a black out). b. Restrictions on redemption can be imposed for a specified period of time, not exceeding 10 working days in any 90-day period. c. Any imposition of restrictions will require specific approval of the boards of asset management companies (AMCs) and trustees and SEBI should be informed about this immediately. d. When restrictions on redemption are imposed, the following procedure shall be applied: i. All redemption requests up to INR 2 lakh shall not be subject to such restrictions. ii. Where redemption requests are above Rs. 2 lakh, AMCs shall redeem the first Rs. 2 lakh without such restrictions and the remaining part over and above Rs. 2 lakh shall be subject to such restrictions. For further details, please see the SEBI circular SEBI/HO/IMD/DF2/CIR/P/2016/57 dated May 31, 2016.

In terms of SEBI (Mutual Funds) (Amendment) Regulations, 2017 dated February 15, 2017 and SEBI Circular dated February 28, 2017, mutual funds were allowed to invest in hybrid securities such as units of REITs and InvITs subject to investment restrictions. Any existing scheme intending to invest in units of REITs/InvITs would have to abide by the provisions of Regulation 18 (15A) of SEBI (Mutual Funds) Regulations, 1996. For investment in units of REITs/InvITs by an existing MF scheme, unit holders of the scheme were given a time period of at least 15 days for the purpose of exercising the exit option. In accordance with SEBI (Mutual Funds) (Amendment) Regulations, 2017 dated February 15, 2017 and SEBI Circular dated February 28, 2017, the Mutual Fund under all its schemes shall not own more than 10% of units issued by a single issuer of REIT and InvIT. At a single Mutual Fund Scheme level, it shall not own: i. more than 10% of its NAV in the units of REIT and InvIT; and ii. more than 5% of its NAV in the units of REIT and InvIT issued by a single issuer. Depending on the development of the market, the internal investment norms are required to be submitted to the Board of AMC for approval before making any investment in units of REITs/InvIT. For further details, please see the SEBI circular SEBI/HO/IMD/DF2/CIR/P/2017/17 dated February 28, 2017.

The Instant Access Facility (IAF) enables mutual fund investors to quickly access their invested funds in specific schemes. It ensures that redemption proceeds are credited to the investor's bank account on the same day the redemption request is made. This facility aims to provide investors with quick access to their investments (up to a certain limit) to address urgent financial needs.

In order to enhance liquidity, depth for efficient price discovery and price risk management in the commodity derivatives segment, various committees, including those constituted by the Government of India, have recommended participation of institutional investors in the commodity derivatives markets. Taking cognizance of the fact that participation by institutional investors and based on the recommendation of the Commodity Derivatives Advisory Committee (CDAC), SEBI allowed Category III Alternative Investment Funds, Mutual Funds and Portfolio Management Services to participate in ETCDs with certain conditions prescribed vide Circular dated June 21, 2017. The sub-group of CDAC recommended the opening of ETCDs to other institutional investors in a phased manner. In phase I, Category III Alternative Investment Funds (AIFs), Portfolio Management Services (PMS), Mutual Funds and direct participation of foreign participants having exposure to commodities were allowed and in phase II, banks, insurance/reinsurance companies, foreign portfolio investors (FPIs), pension funds were permitted. While Category III AIFs were already permitted, the participation by mutual funds and FPIs were permitted subsequently vide circular dated April 26, 2019 and September 29, 2022, respectively.

In order to enhance liquidity & depth for efficient price discovery and price risk management in commodity derivatives segment, various committees including those constituted by the Government of India have recommended participation of institutional investors in the commodity derivatives markets. Taking cognizance of the fact that participation by institutional investors and based on the recommendation of the Commodity Derivatives Advisory Committee (CDAC), SEBI allowed Category III Alternative Investment Funds, Mutual Funds and Portfolio Management Services to participate in ETCDs with certain conditions prescribed vide Circular dated June 21, 2017. The sub-group of CDAC recommended the opening of ETCDs to other institutional investors in a phased manner. In phase I, Category III Alternative Investment Fund (AIF), Portfolio Management Services (PMS), Mutual Funds, direct participation of foreign participants having exposure to commodities were allowed and in Phase II, Banks, Insurance/reinsurance companies, Foreign Portfolio Investors (FPIs), Pension Funds were permitted. While Category III AIFs were already permitted, the participation by Mutual funds and FPIs was permitted subsequently vide circular dated April 26, 2019 and September 29, 2022, respectively.

For enhancing the reach of mutual fund schemes to more towns and cities, the use of stock exchange terminals for facilitating transactions in mutual fund schemes is helpful and in this regard, several measures were undertaken by SEBI in the past. In continuation of its earlier efforts, SEBI permitted investors to directly access the infrastructure of the recognised stock exchanges to purchase and redeem mutual fund units directly from MF/AMCs in February 2020.

SEBI prescribed all Mutual funds to undertake at least 10% of their total secondary market trades by value in the Corporate Bonds by placing/seeking quotes on the Request for Quote (RFQ) platform of stock exchanges.

SEBI prescribed Mutual funds to maintain at least 10 per cent of their net assets in liquid assets (i.e. in cash, G-sec, T-bills and repo on Government Securities) in all open-ended debt schemes.

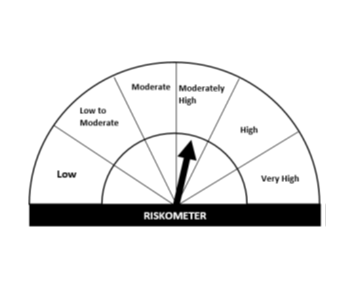

In the context of earlier SEBI circulars ‘Product Labelling in Mutual Funds’ and based on the recommendations of the Mutual Fund Advisory Committee (MFAC), SEBI reviewed the guidelines for product labelling in mutual funds.

The skin-in-the-game requirement was enforced for Asset Management Companies (AMCs) and their designated employees to ensure alignment of interests between key employees and unitholders, fostering greater ownership and discipline among fund managers.

The Finance Act 2020 amended Section 9A of the Income Tax Act, 1961, enabling resident Indian fund managers, beyond individuals, to be constituents of Foreign Portfolio Investors (FPIs). This amendment, along with amendments to SEBI regulations, aims to encourage Indian fund managers to contribute seed capital to offshore investment funds, fostering new business opportunities.

In the case of mutual funds, the mechanism of swing pricing is intended to protect existing investors of a fund from the costs incurred when other investors buy or sell units in that fund. In cases of severe liquidity stress at the AMC level or severe dysfunction at the market level, the Swing Pricing Guidelines gets triggered, which offer a contingency plan in case everything else fails. SEBI, on September 29, 2021 issued the swing pricing framework for open-ended debt mutual fund schemes, except overnight funds, gilt funds, and gilt with 10-year maturity funds. However, based on the request received from AMFI, the date for implementation of the provisions of the aforesaid circular was postponed to May 1, 2022.

SEBI vide circular dated February 9, 2022 prescribed framework for conversion of private unlisted InvIT into private listed InvIT.

Accredited Investors (AIs) for the limited purpose of Innovators Growth Platform (“IGP”) are investors whose holding in the issuer company, is eligible for the computation of at least 25% of the pre-issue capital in accordance with Regulation 283.(1) of the SEBI (Issue of Capital & Disclosure Requirements) Regulations, 2018 (“ICDR Regulations”). Accordingly, SEBI vide circular dated May 22, 2019, issued a framework for process of accreditation of investors for IGP. The framework for 'Accredited Investors’ was introduced to recognize the class of investors who are considered to be well-informed or well-advised about investment products. This framework grants Accredited Investors (AIs) potential advantages such as reduced minimum investment requirements ("lower ticket size") or exemptions from specific regulatory obligations pertaining to investment products, contingent upon meeting prescribed criteria. With the adoption of the accredited investors (AIs) framework, Alternative Investment Funds (AIFs) are anticipated to experience growth and make increased contributions to India's economic advancement.

Enabling FIPs in the securities market i.e. Depositories and Mutual Fund Asset Management Companies through their Registrar and Transfer Agents to provide financial information to Account Aggregator (AA) is yet another major step towards digitisation effort. The provision would enable credit lending institutions and banks to access the securities market data related to financial assets held by credit seekers and lead to better credit/ lending decisions.

In order to enhance the liquidity, depth for efficient price discovery and price risk management in commodity derivatives segment, various committees including those constituted by the Government of India have recommended participation of institutional investors in the commodity derivatives markets. Taking cognizance of the fact that participation by institutional investors and based on the recommendation of the Commodity Derivatives Advisory Committee (CDAC), SEBI allowed Category III Alternative Investment Funds, Mutual Funds and Portfolio Management Services to participate in ETCDs with certain conditions prescribed vide Circular dated June 21, 2017. The sub-group of CDAC recommended the opening of ETCDs to other institutional investors in a phased manner. In phase I, Category III Alternative Investment Fund (AIF), Portfolio Management Services (PMS), Mutual Funds and Direct participation of foreign participants having exposure to commodities were allowed and in Phase II, Banks, Insurance/reinsurance companies, Foreign Portfolio Investors (FPIs), Pension Funds were permitted. While Category III AIFs were already permitted, participation by Mutual funds and FPIs were permitted subsequently vide circular dated April 26, 2019 and September 29, 2022, respectively.

In order to improve the quality and accuracy of financial data systems, all non-individual FPIs were mandated to provide their Legal Entity Identifier (LEI) details in the Common Application Form (CAF). Further, FPIs were also mandated to ensure that their LEI is active at all times. Accounts of FPIs with expired/lapsed LEI codes were blocked for further purchases in the securities market untill the time their LEI code was renewed.

Certain FPIs have been observed to hold a concentrated portion of their equity investments in single Indian companies or corporate groups, raising concerns about regulatory circumvention. Identifying beneficial owners of FPIs remains difficult due to fragmented ownership. New SEBI regulations mandate detailed disclosures on persons having any ownership, economic interest, or control in FPIs with significant Indian equity holdings to ensure market stability and transparency.