Read Articles

SEBI - An Evolution of Legislative Empowerment

The article traces the evolution of SEBI from its conceptualization in the G.S. Patel Committee Report, 1985 to its establishment in the year 1988, its empowerment through legislation as a statutory body in the year 1992 and beyond. Accordingly, this article highlights the salient features of Acts such as the SEBI Act, 1992, the Depositories Act, 1996, the Securities Contracts [Regulation] Act, 1956, and the Companies Act, 2013. The article also delves into the details of the important legislative empowerment of SEBI through legislative amendments in the years 1995, 1999, 2002, 2004, 2014, 2015 and 2019.

SEBI - An Evolution of Securities Market Reforms

The article explores SEBI's role in fostering the growth of the Indian securities market through transformative reforms, including derivatives trading, dematerialization, insider trading regulations, and the introduction of various investment products.

Collectibles of Handbook of Statistics

Following is the collection various Handbook of Statistics of Indian Securities Market. The Handbook of Statistics may be downloaded from the link provided.

A Story of Establishment of SEBI

The Securities and Exchange Board of India was established in 1988 following recommendations from various committees and the need for regulatory oversight in the Indian capital markets

Curated Weblinks Data of Indian Securities Markets

Curated Weblinks Data of Indian Securities Markets

Collectibles of Acts

Following is the collection various Acts of Indian Securities Market. The acts may be downloaded from the link provided.

Collectibles of Annual Report

Following is the collection various annual reports of Indian Securities Market. The annual report may be downloaded from the link provided.

COLLECTION OF COMMITTEE REPORTS

Following is the collection various committee reports related to Indian Securities Market. The committee report may be downloaded from the link provided.

Watch Videos

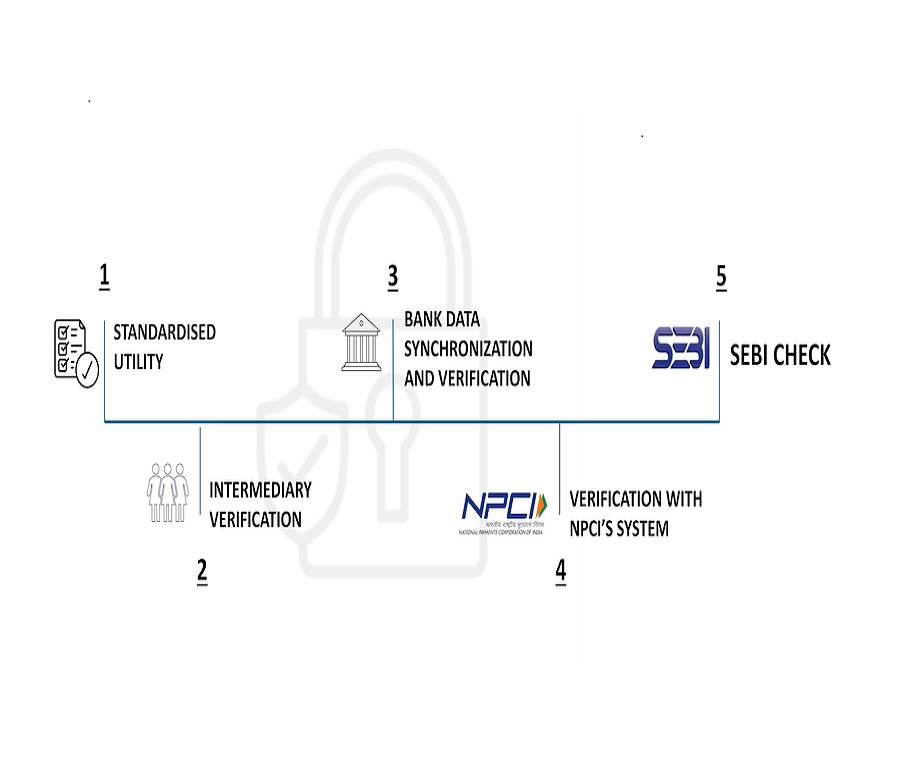

SEBI Introduced Validated UPI Handles and SEBI Check

SEBI announced a significant initiative to enhance investor protection and combat unauthorized money collection in the securities market. Effective October 1, 2025, SEBI will introduce a structured and validated UPI address mechanism, featuring the exclusive valid handle, for all SEBI-registered investor-facing intermediaries.

Application Supported by Blocked Amount in Secondary Market

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack

Central Demise Reporting

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack

Security and Covenant Monitoring Platform

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack

Software as a Service

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack

Investor Risk Reduction Access

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack

Logging and Monitoring Mechanism

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack

Application Supported by Blocked Amount ASBA in Primary Market and Listing in T+3

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack

Equity T+1 and Beta version of T+0 settlement cycle

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack

Monitoring of Clients Funds with Trading Members

SEBI SMART 2025- A symposium of Indian Securities Market Tech Stack